Many factors can influence how much a business insurance policy will cost for your company. Rates vary according to the size and type of business you own, the value of your commercial property, the liability risks in your industry, and the number of people you employ. There are many different policies and options that you can choose from as you customize your business insurance coverage package. An independent insurance agent can help you be sure you are getting competitively priced coverage to protect against all of your company’s exposures.

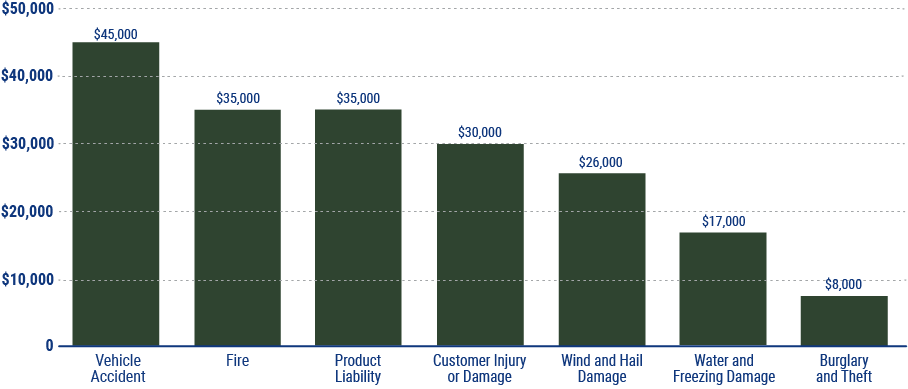

Average Cost of Top Business Insurance Claims in the US