Does the sound of owning a business sound exciting and rewarding? While it can be a real adventure, it can also be a nightmare if you're not well equipped. Kentucky business insurance doesn't have to cost a fortune when you have the right help.

Fortunately, a Kentucky independent insurance agent does the shopping for free, saving you time and money. They work with only highly rated carriers so that you're presented with coverage that doesn't break the bank. Connect with a local expert to get started in minutes.

What Is Business Insurance?

When you're growing a business, you may not think insurance has a lot to do with your success, but it does. One loss could wipe out your dreams in a matter of seconds if you're not adequately covered. Take a look at standard policy options for your Kentucky business below:

- General liability: Pays for bodily injury and property damage claims.

- Business property: Pays for the replacement and repair of property owned by the business.

- Business inventory: Pays for the replacement and repair of inventory owned by the business.

- Business equipment breakdown: Pays for the replacement and repair of business equipment that breaks down.

- Commercial umbrella liability: Pays for additional liability coverage when a loss exceeds your underlying limits.

- Workers' compensation: Pays for the medical expenses and lost wages of an employee who gets injured or becomes ill on the job.

- Business interruption coverage: Protects against an actual loss sustained by an insured as a result of direct physical loss or damage to the insured's property.

How Much Does Insurance Cost for a Startup Business in Kentucky?

Kentucky has 351,260 small businesses currently in existence. There are numerous items that carriers look for when setting rates for your startup. Since you're new to the game, check out what matters to insurance companies regarding your premiums:

- What industry you're in

- Your experience level

- If you have any employees

- Your location

- What your processes and procedures are

- If you're proactive

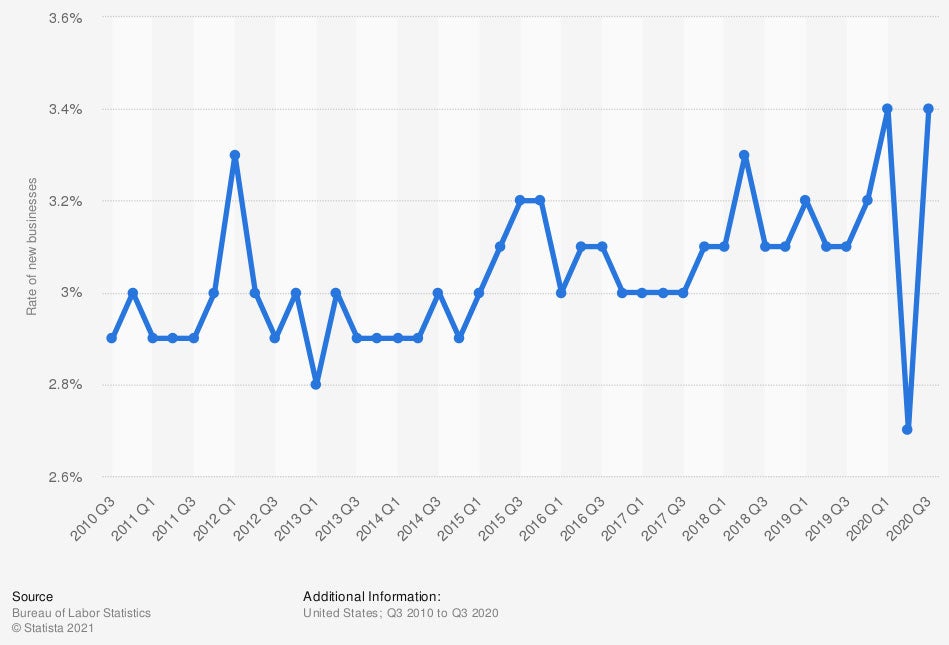

Quarterly rate of business starts in the US

Because you have a new venture, carriers have nothing to go off of concerning your past operations. This means they'll charge you a higher rate on coverage until you prove yourself trustworthy in business.

How Much Does Business Insurance Cost in Kentucky?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in one year alone. Several factors impact your business insurance pricing, and past claims are one of them. Carriers use the following information to rate your insurance:

- Loss history

- Replacement cost values

- Insurance score

- Experience level

- Type of business

- Location

How Much Does Business Car Insurance Cost in Kentucky?

Business insurance policy pricing will depend on your industry and how risky it is. Coverage selected and limits necessary also play a role in your premiums. The radius in which you travel, driving records, and units insured will affect commercial auto insurance costs for your company.

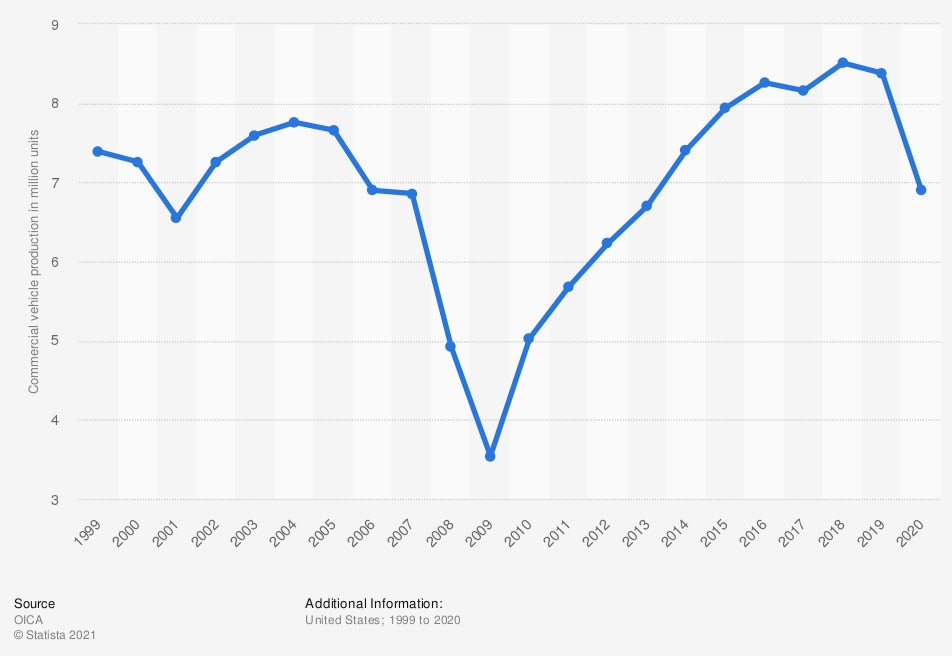

US commercial vehicle production (in million units)

Commercial autos are still in high demand and used every day by companies around the US. If your business needs vehicles in its daily operations, then you'll want the proper protection.

How an Independent Insurance Agent Can Help in Kentucky

Every business needs proper protection for all that life throws at it. Fortunately, you'll have several options when it comes to policies and coverages. Knowing what's necessary for your operation can be a challenge, so consider using a licensed adviser for free.

A Kentucky independent insurance agent does the shopping through their network of carriers. They'll even compare policies for the most competitive premiums and present you with the best one. Connect with a local expert on trustedchoice.com for tailored quotes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/771407/quarterly-business-start-rate-us/

https://www.statista.com/statistics/198505/us-commercial-vehicle-production-since-1999/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.