As a business owner, you'll be responsible for growing and maintaining your operation. This includes everything that could go wrong and losses that pop up along the way. Kentucky business insurance will have multiple policy options for all the what-ifs.

A Kentucky independent insurance agent will do the shopping through their network of carriers so that you can relax. They'll compare policy and premiums for free, saving you time and money. Connect with a local expert to get started today.

What Is Business Insurance?

Your Kentucky business should have the protection necessary to file a claim in the event you have a loss. Several coverages could apply to your operation. Check out some policies your business may want to consider:

- General liability: Pays for a bodily injury or property damage loss.

- Business property: Pays for the replacement or repair of property owned by the business.

- Business inventory: Pays for the replacement or repair of inventory owned by the business. This can include spoilage coverage as well.

- Workers' compensation: Pays for an injured or ill employee's medical expenses and lost wages when hurt on the job.

- Business auto: Pays for commercial vehicles involved in an accident or loss due to business operations.

- Employment practices liability: Pays for a discrimination or harassment lawsuit filed by a disgruntled employee.

What Does Business Insurance Cover in Kentucky?

Kentucky has 351,260 small businesses in existence currently. Understanding what your policies will and won't cover is essential. Let's look at standard insurance options for your business:

- Coverage for claims of bodily injury or property damage

- Coverage for food and inventory spoilage

- Coverage for your business property that is damaged due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

There are common losses that will be automatically insured under each commercial policy. This includes coverage for fire, natural disasters, theft, vandalism, and water damage.

How Much Is Business Insurance in Kentucky?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in one year alone. Each business will have premiums unique to its loss history and other varying factors. Take a look at the factors companies use when quoting:

- Loss history

- Replacement cost values

- Experience level

- Location

- Local crime rate

- Local weather patterns

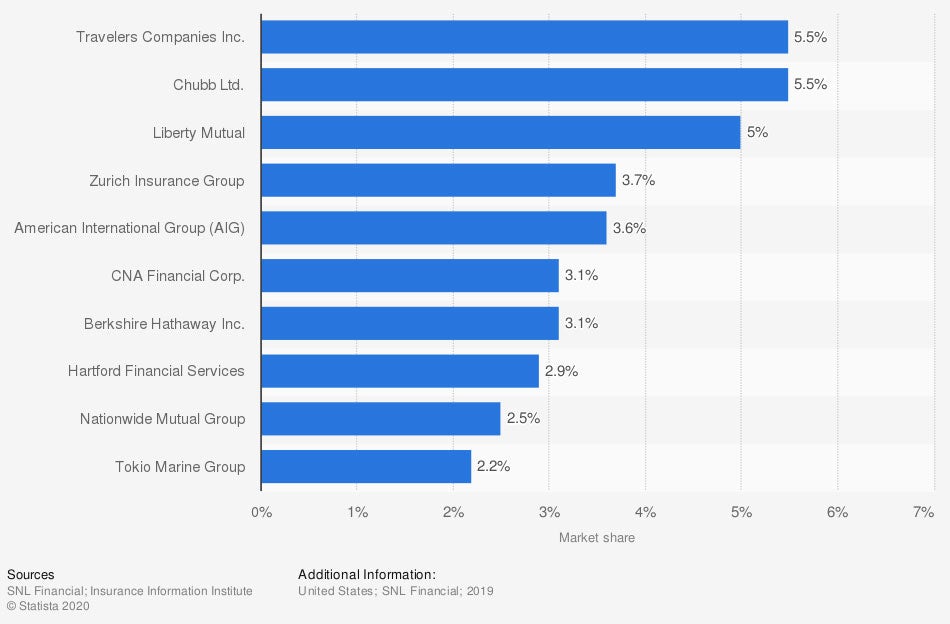

Market share of commercial lines insurance companies in the US, by direct premiums written

For exact pricing on your business policies, you'll need to obtain quotes through a licensed adviser. It's good to know which carriers your peers use most often.

What Are Some Additional Business Insurance Policies in Kentucky?

Every policy will come with numerous coverage types that may or may not apply to your operation. Check out some additional insurance options that could help:

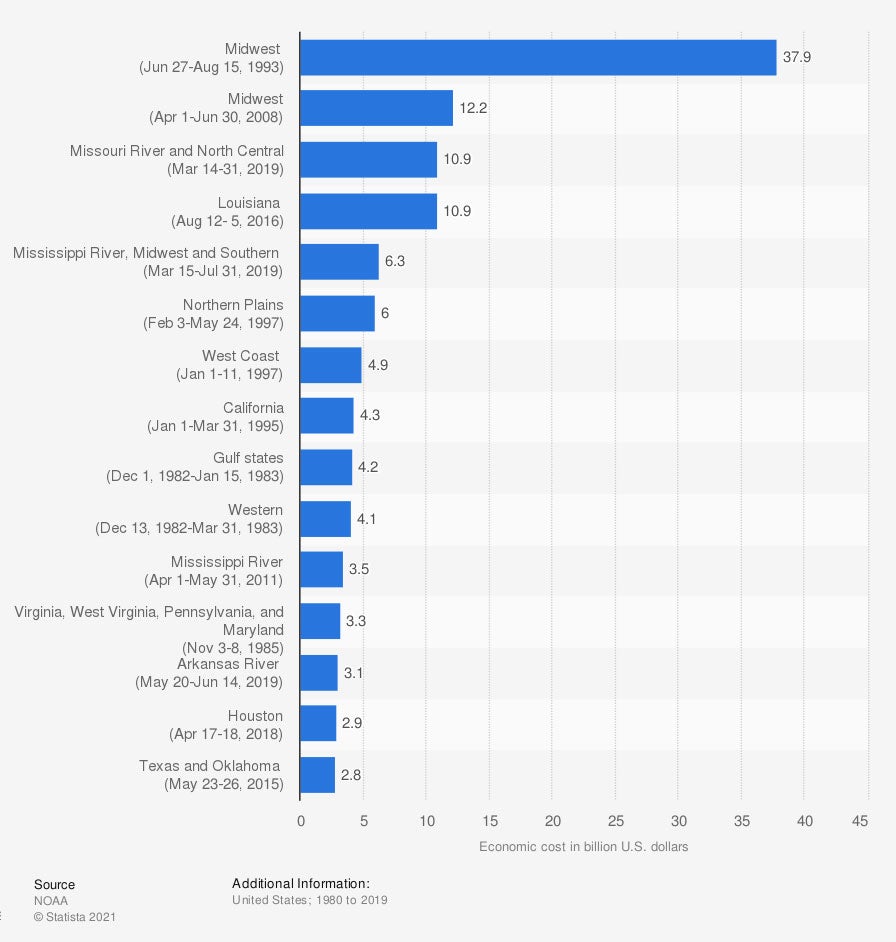

- Flood insurance: This is a separate policy that pays for damage to your business property caused by a flood.

- Business umbrella insurance: Pays for a more significant liability loss that exhausts your underlying bodily injury and property damage policy limits.

- Business interruption insurance: This coverage can be added to your general liability policy and will pay to keep your business open when a covered loss closes you down.

Major flooding events in the US, by economic cost

If your business is without flood insurance or any of the above policy options, you'll be on your own. One way around this is by obtaining the proper protection from the get-go.

How an Independent Insurance Agent Can Help in Kentucky

When you're searching for the perfect business insurance in Kentucky, it can be a challenge. Sometimes you don't know what you don't know, which can make finding the correct policies confusing. Fortunately, a licensed adviser can help review your insurance for free.

A Kentucky independent insurance agent does the shopping through their network of carriers. They'll compare with dozens of highly rated markets so that you're completely protected. Connect with a local expert on trustedchoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffery Green

https://www.statista.com/statistics/186464/leading-us-commercial-lines-insurance-by-market-share/

https://www.statista.com/statistics/1116782/major-floods-us-economic-cost/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.