When you're cruising the streets as your means to get around, you need to be aware of some things. First, to have proper protection from an accident or loss, the correct coverage is necessary. Second, Kentucky car insurance doesn't have to be expensive if you know where to look.

A Kentucky independent insurance agent has a network of carriers so that you're fully covered for an affordable price. They'll even do the shopping for you at no additional cost. Connect with a local expert to get started today.

What Is Car Insurance?

If you use the roads to travel to and from places, you'll be required to carry the minimum liability limits in Kentucky. Most states mandate coverage in some form, and Kentucky is one of them. Take a look at how coverage works:

- Car insurance: Pays for a bodily injury or property damage lawsuit caused by a motor vehicle accident.

- Minimum liability limits required in KY: $25,000 per person bodily injury limit/ $50,000 per accident bodily injury limit/ $25,000 for property damage per accident.

What Is the Average Cost of Car Insurance in Kentucky?

You can tell a lot by the average costs in your area. In Kentucky, you could be on a high or low end of the spectrum when it comes to car insurance premiums, depending on your specifications. Check out the rates below:

- National average cost of car insurance: $1,311

- Kentucky average cost of car insurance: $1,341

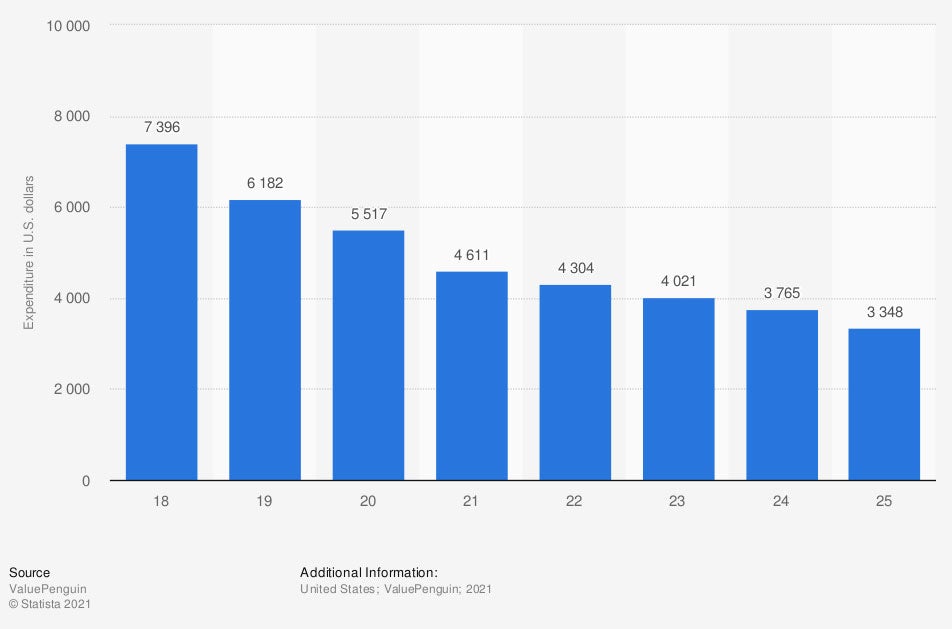

Average auto insurance expenditure in the US in a recent year, by age (in US dollars)

If you're looking for exact pricing, then you'll need to obtain quotes. Every carrier calculates premiums on an individual basis.

How Is Your Car Insurance Calculated in Kentucky?

Insurance companies use a variety of risk factors when rating your premiums. Your surroundings, loss history, local crime, and more will determine how much you have to pay in car insurance. Check out the vehicle theft rates per 1,000 people below:

- National vehicle theft rates: 2.289

- Kentucky vehicle theft rates: 2.296

Other factors that are looked at are the ages of licensed drivers on the policy, the value of each vehicle, and coverages selected. Every policy will be unique and have pricing specific to the driver.

How Are Additional Coverages Calculated in Kentucky?

In Kentucky, you'll have choices when it comes to coverages for your car insurance. A standard auto policy will have minimum limits of liability automatically, and that's it. If you want additional protection, you'll have to add it.

Optional car insurance coverages:

- Gap coverage: Pays for the difference between your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Comprehensive coverage: Will pay for property damage to your vehicle that is hit by an unavoidable obstruction. It also pays for fire, theft, vandalism, and severe weather damage.

- Collision coverage: Pays for property damage to your car in the event of a crash when you're at fault.

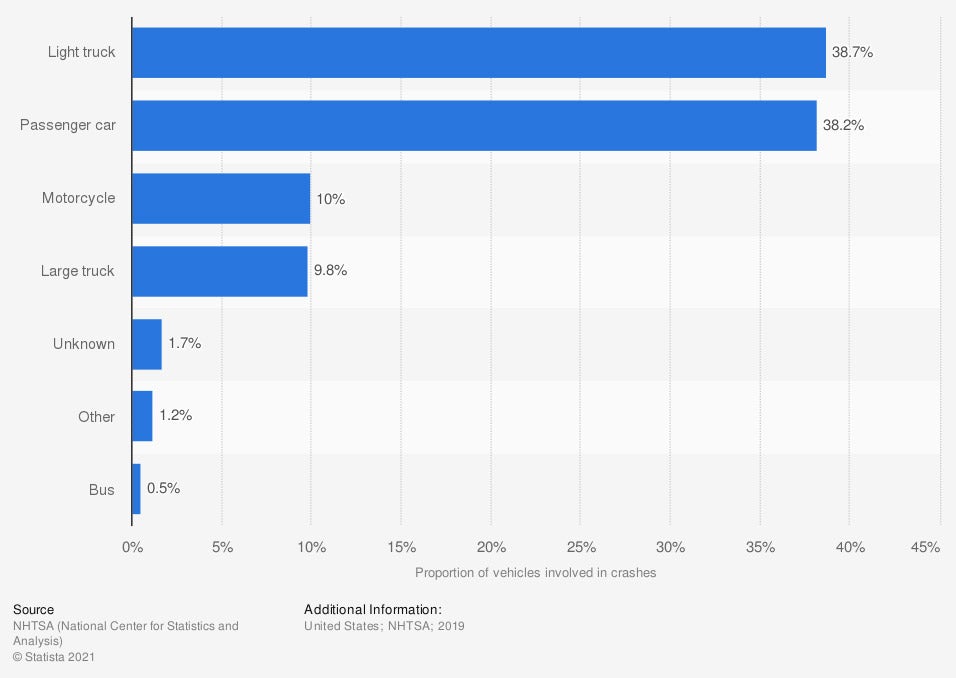

Distribution of vehicles involved in fatal traffic crashes in the US in one recent year

While you may not be required to carry more coverage, it should seriously be considered. The number of car accidents in the country is high, and having the right policy is crucial. The cost for this extra coverage varies and needs to be quoted for your specific prices.

Reasons Why Your Car Insurance Rates May Be Higher in Kentucky

The lowest-priced car insurance is relative. Your neighbor won't have the same insurance premium as you. That's because carriers individualize your costs based on your exposures.

Things that could make your car insurance more expensive in Kentucky:

- An at-fault accident in the past 3 to 5 years

- A driving record with some history on it

- Youthful drivers on your policy

- The type of coverage you select

- The value of your vehicles

- How safe your location is

How a Kentucky Independent Insurance Agent Can Help

When you're shopping for the best car insurance in Kentucky, it may seem overwhelming. There are numerous options to choose from, which can make it confusing if you're not a licensed adviser. Fortunately, there are trained professionals that can help for free.

A Kentucky independent insurance agent does the shopping for you at zero cost. This means you'll have options on coverage and rates so that you're not breaking the bank. Connect with a local expert on trustedchoice.com for custom quotes to get started.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/555827/auto-insurance-costs-usa-by-age/

https://www.statista.com/statistics/192089/vehicles-involved-in-traffic-crashes-in-the-us/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.