Many farms wouldn’t be nearly as valuable or successful without their crops. That’s why it’s so important to ensure that they’re protected at all times. But you may not be aware of whether your premiums are tax-deductible.

Fortunately a Kentucky independent insurance agent can not only help you get set up with the proper type of crop insurance for you, but also explain if and when it’s tax-deductible. But first, here’s a deep dive into this important topic.

What Is Crop Insurance?

Crop insurance is just one important aspect of a complete Kentucky farm insurance package. Crop insurance is designed to protect your farm’s crops from numerous disasters including various types of storm damage, fire, drought, and more.

Without the right crop insurance, your farm could end up facing a devastating loss after just one incident. Be sure to speak with a Kentucky independent insurance agent about crop insurance as soon as possible.

What Does Crop Insurance Cover in Kentucky?

What your crop insurance policy covers will depend on which specific type of coverage you buy. There are several options when it comes to crop insurance, but coverage can include protection against the following disasters and more:

- Drought and frost damage

- Fire damage

- Flood damage

- High wind and hail damage

- Insect damage or infestations

- Disease outbreaks

Your Kentucky independent insurance agent can help recommend the type of crop insurance policy that best covers your unique farm’s exposures.

What Is Tax-Deductible Coverage?

Tax-deductible coverage refers to insurance that can be deducted from your taxes. The premiums that you pay for your coverage out of pocket can sometimes be subtracted from your annual taxable income.

If your insurance is tax-deductible, you can lower your overall taxable income, which in turn lowers your tax liability. That means you’re likely to owe less when it comes time to file taxes, and possibly even get a higher refund.

Is Crop Insurance Tax-Deductible in Kentucky?

According to insurance expert Jeffery Green, generally all forms of business insurance premiums are deductible with one important exception, individual life insurance policies. Since crop insurance is purchased for farms for business purposes, crop insurance falls into this category.

That means you’ll probably be able to deduct your Kentucky crop insurance premiums from your taxable income. Of course, it’s always worth double-checking with your Kentucky independent insurance agent, or even with your attorney, to be certain.

How Common Are Crop-Hail Losses in Kentucky?

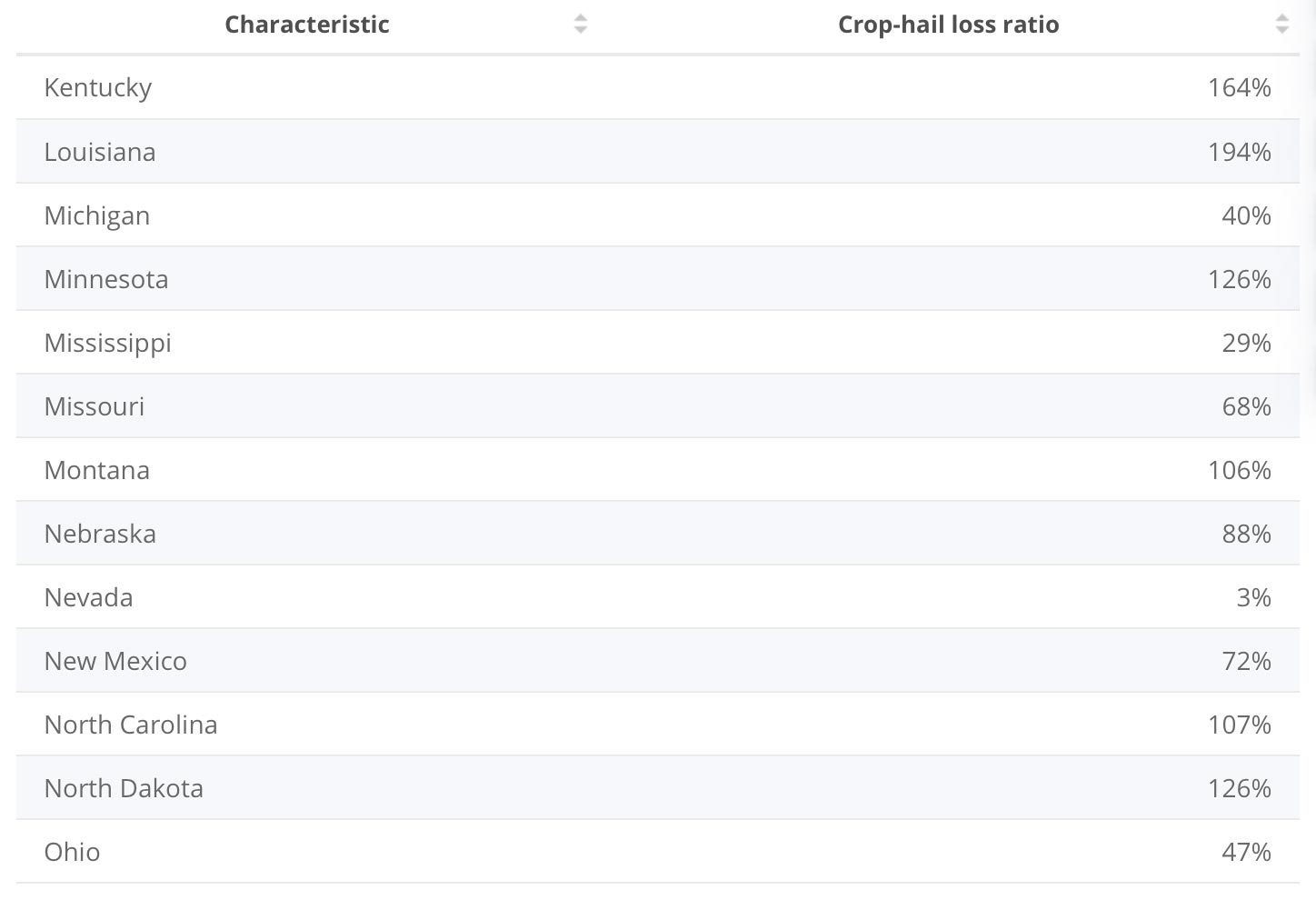

When considering which kind of coverage you need for your crops, it’s helpful to know how often farmers in your area use specific types of insurance. Check out these crop-hail insurance loss ratios by state, including for Kentucky.

Crop-hail loss ratio in the US, by state

In one recent year, Kentucky was one of many states that surpassed a 100% loss ratio from crop-hail insurance. Kentucky’s crop-hail insurance’s loss ratio was 164%, which, while significant, fell a bit below Louisiana, which had a loss ratio of 194%.

A crop-hail loss ratio of greater than 100% means that the insurance companies operated at a loss, paying out more for claims than they made in premium payments. Knowing this, it’s crucial to be equipped with at least crop-hail insurance for your Kentucky farm.

Are There any Liabilities That Can Influence My Deductible?

The deductible that you pay for your crop insurance will again depend on the specific type of coverage you get. Crop-hail policies often have a much lower deductible, or even no deductible at all. That’s because hail damage can destroy one part of a crop while leaving the rest intact.

Since a crop-hail policy claim is likely to cost much less than a regular crop insurance claim for drought, disease, etc., the deductible is able to be much lower. A Kentucky independent insurance agent can further explain all the factors that influence your policy’s deductible.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect farm owners against commonly faced disasters and liabilities. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in crop insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

https://www.statista.com/statistics/791462/crop-hail-loss-ratio-usa-by-state/

https://www.iii.org/article/understanding-crop-insurance

https://www.investopedia.com/ask/answers/042315/what-difference-between-loss-ratio-and-combined-ratio.asp

© 2025, Consumer Agent Portal, LLC. All rights reserved.