An electric fire can happen at any time, even in a brand-new home. If an electric fire starts shortly after you move into your Kentucky home, is it your responsibility to pay for the damage, or does the blame fall on the building company or contractor?

Questions like this tend to be a gray area for most homeowners, so a Kentucky independent insurance agent is an excellent person to have on your side. An agent can help you understand what unexpected situations can arise in your home and when you'd be financially responsible. They can also get you set up with the right home insurance, so you're protected when accidents happen.

If There's an Electric Fire in My Brand New Home, Who's Responsible?

Responsibility for an electric fire in a brand-new home depends on several factors. The following questions help insurance carriers determine if the fire was your fault or that of the building company or contractor.

- What caused the electric fire to start?

- Where is the damage?

- Was the electrical wiring done improperly?

- Was the fire the fault of the homeowner?

Even if the cause of the electric fire were the building company, it would be your responsibility to file the claim, since you're currently occupying the home.

What If the Builder Won’t Claim Responsibility?

Suppose the builder is found responsible for the damage but won't claim responsibility. You could take legal action. Your insurance company will work with the business and attempt to get reimbursed.

If you chose to take legal action, you'd likely pay for any fees related to the lawsuit out of pocket. Depending on the amount of damage from the electric fire, this may not be worth taking to court. Before you take any legal action against a company or professional, it's best to speak with an attorney to make sure it's the right decision.

Am I Responsible for Covering Any Damage Caused by the Electric Fire?

If the electric fire was not caused by faulty workmanship and occurred because of a covered event, your insurance company would have to pay the claim. You would receive coverage up to your property damage limits within your home insurance policy. Property damage includes limits for structural damage and damage to your personal belongings. Anything beyond these limits or outside of this coverage would be paid out of pocket.

For this reason, setting the proper policy limits is a crucial part of purchasing home insurance. A Kentucky independent insurance agent can help you develop your limits to protect you from small to significant events.

Will My Rates Increase Even If I'm Not Responsible for the Damage?

The good news is that a single incident such as an electric fire does not typically lead to a rate increase on your home insurance. Your insurance company would even consider that the fire wasn't your fault.

Home insurance rates start to increase if you're filing continuous claims or are causing multiple insurance claims in your home. At that point, your insurance would start considering you a risky homeowner and would increase your premiums or not renew your coverage to reflect that.

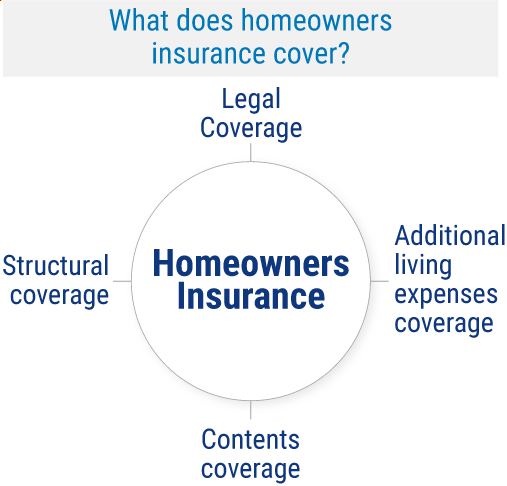

What Does Kentucky Homeowners Insurance Cover?

From fires and wind to theft, vandalism, and damage from severe storms, home insurance covers your stuff, the people living in your home, and the structure of your home for accidents and unexpected situations. Kentucky home insurance includes four essential protections:

- Contents coverage: Located within your property damage insurance, contents coverage protects your stuff like clothing, silverware, furniture, etc., against disasters like fire, theft, etc.

- Structural coverage: Also within your property damage insurance, structural coverage protects the home’s structure and detached structures from perils like natural disasters, fire, vandalism, etc.

- Legal coverage: Homeowners insurance provides liability coverage against lawsuits filed by third parties. This coverage reimburses legal costs like attorney and court fees.

- Additional living expenses coverage: Homeowners insurance also covers extra expenses if your home becomes temporarily uninhabitable after a covered disaster strikes. This coverage reimburses extra expenses like hotel rooms, additional mileage, meal costs, etc.

What Doesn't Homeowners Insurance Cover in Kentucky?

Understanding what is not covered by homeowners insurance is just as important as knowing where you're protected. If you know a particular event will not be covered, you can work with your agent to see if there are add-on policies to cover your gaps.

These are some of the most common things that home insurance in Kentucky does not cover:

- Routine maintenance fees

- Lack of upkeep by the homeowner

- War/nuclear fallout damage

- Business-related liability issues

- Insect damage

- Flood or earthquake damage

Fifteen percent of the properties in Kentucky are at risk of flooding in the next 30 years. For this reason, it's a good idea to consider purchasing flood insurance in Kentucky if you live in a high-risk flood zone. An agent can help you secure flood coverage.

What Are the Top Five Risks for Homeowners in Kentucky?

In addition to flooding and electric fires, Kentucky homeowners have a few other risks. Knowing the top risks for your home can help you prepare before something happens. With the right coverage in place, the financial damage from an unexpected event can be less severe.

Top five risks for homeowners in Kentucky

- Severe storms and lightning: Severe storms and lightning can lead to flooding, wind and hail damage, and fires. Data from a recent year shows that Kentucky experienced 80 severe storms.

- Flooding and water damage: One inch of floodwater from a storm can cause up to $25,000 in damage to your home.

- Wildfires and residential fires: There is an average of 1,447 wildfires across Kentucky every year. If a wildfire strikes your home, it can burn down your entire property.

- Tornadoes: Each year, 21 tornadoes occur in the state of Kentucky.

- Burglary and other property crimes: There are more than 79,000 property crimes in Kentucky every year. One in 57 people living in Kentucky is at risk of being a victim of a property crime.

How Can a Kentucky Independent Insurance Agent Help?

Unexpected electric fires and other home disasters can be financially devastating without the right coverage in place. Fortunately, home insurance can help out in most situations, as long as you have the right coverage and adequate policy limits.

Kentucky independent insurance agents are experts in home insurance and can ensure that you have the coverage you need. They'll shop multiple quotes and guide you in selecting a policy that fits your needs. Agents are there to answer questions and even help you file a claim if an incident occurs in your Kentucky home.

Article reviewed by | Paul Martin

https://www.iii.org/article/homeowners-insurance-basics

https://www.neighborhoodscout.com/ky/crime

https://eec.ky.gov/Natural-Resources/Forestry/Pages/Forest-Facts.aspx#:~:text=The%20average%20number%20of%20wildland,of%20wildland%20fires%20in%20Kentucky

https://www.fema.gov/sites/default/files/2020-05/8.5x11_1_inch_flyer.pdf