You know your home needs to be protected against many disasters, from storms to vandalism and beyond. But you might be unsure of just how much it’ll cost you to have the proper coverage. Fortunately it’s not difficult to calculate homeowners insurance costs in Kentucky.

Kentucky independent insurance agents can provide you with specific quotes and rates for your area. They’ll also help you find the right policy for your needs. But until then, here’s a closer look at homeowners insurance and how much it costs.

Average Cost of Homeowners Insurance

You might be relieved to know that homeowners insurance in Kentucky is, on average, cheaper than the US overall. Being familiar with homeowners insurance rates in your area can help you prepare your budget before shopping for coverage.

Here’s how Kentucky homeowners insurance rates stack up against the US average:

- Home insurance in the US costs $1,211 annually.

- Home insurance in Kentucky costs $1,109 annually.

- Kentucky ranks 26th out of all states for the most expensive home insurance rates.

- Kentucky residents pay about $1,224 less annually for coverage than the US average.

A Kentucky independent insurance agent can help you find more exact figures for your specific city and home.

How to Calculate Home Insurance in Kentucky

The simplest way to calculate home insurance rates in your area is to work together with a Kentucky independent insurance agent. Not only are they familiar with the type of coverage that would work best for your specific needs, but they also know all the factors that go into determining its cost.

Local Kentucky independent insurance agents have the advantage of knowing average rates in your city. Even better, they’re also skilled in finding any discounts you may qualify for on your coverage. They’ll help shop around and compare policies to get you the best rate.

Home Insurance Cost Factors in Kentucky

Many factors determine the cost of your home insurance policy. According to insurance expert Paul Martin, these are a few of the most common factors that go into home insurance pricing:

- Age of the home: Since older homes can be considered riskier to insure and are often in need of updates, they’re also subject to heftier home insurance premiums. Newer homes are considered safer and more up-to-date, and therefore come with cheaper insurance.

- Home updates: Homes with updated wiring, plumbing, AC units, furnaces, etc. can be cheaper to insure than those without. Insurance companies love to reward policyholders that take steps to make their home safer.

- Loss history of the home: Regardless of the age of the home, if it’s got a history of many claims and losses, its insurance rates are likely to skyrocket. Homes without a history of claims and incidents have the added benefit of cheaper coverage.

- Roof condition: Insurance companies see roofs as one of the biggest components in keeping a home safe. As a result, homes with newer or updated roofs can earn a nice break in their coverage costs.

Your Kentucky independent insurance agent can not only provide you with more factors that influence home insurance rates, but also find you the most affordable policy in your area.

Home Insurance Stats

It’s not enough to know that you need homeowners insurance, you also need to be familiar with the consequences of not having it. Check out just how much homeowners insurance companies paid out to residents in the US in recent years.

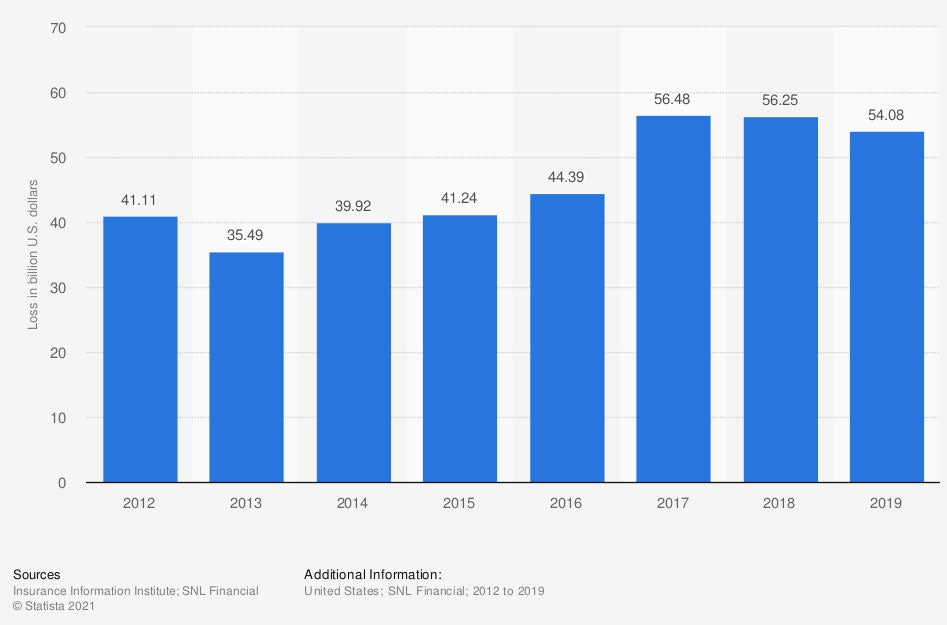

Incurred losses for homeowners insurance in the US

At the beginning of the observed period, homeowners insurance losses amounted to $41.11 billion over just one year. At the end of the period, this number had risen substantially, to $54.08 billion.

So, not only are many US residents equipped with homeowners insurance, but they’re also forced to use frequently. Be sure to chat with a Kentucky independent insurance agent to get your home covered ASAP.

What Does Home Insurance Cover in Kentucky?

Martin said that home insurance includes several important coverages, beyond just for the structure of your home. It’s important to know what all is included in your policy.

Home insurance in Kentucky covers the following:

- Personal property: The contents of your home, or your personal property such as furniture, clothes, etc., are protected against theft, fire, and more.

- The dwelling: The dwelling or structure of your home is protected against many of these same threats as well.

- Additional living expenses: If a severe disaster forces you to relocate while repairs are being made to your home, this coverage reimburses for additional living costs.

- Liability: If you get sued by a third party for claims of bodily injury or property damage, your home insurance also protects you against legal fees.

A Kentucky independent insurance agent can help you review your homeowners insurance policy to find out exactly what all is covered.

What Doesn’t Home Insurance Cover in Kentucky?

Though home insurance in Kentucky covers many aspects of your home, it also comes with its own set of exclusions. Martin said the following are commonly excluded perils under home insurance:

- Routine maintenance

- Insect damage and infestations

- Damage from nuclear fallout and war

- Home-based business liabilities

- Flood or earthquake damage

- Certain explosions

If you’re concerned about what your home insurance doesn’t cover, your Kentucky independent insurance agent may be able to help you add extra coverage.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect homeowners against commonly faced liabilities. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in home insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/428998/incurred-losses-for-homeowners-insurance-usa/

https://www.iii.org/article/homeowners-insurance-basics

https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.