Not only is it important to be equipped with the right car insurance to protect yourself while on the road, it's also important to be familiar with your state's laws about coverage. Before an accident ever occurs, you should understand whether Kentucky is a no-fault state or not.

Fortunately a Kentucky independent insurance agent can not only help answer this question for you, but also get you equipped with the right auto insurance to protect you regardless. They'll get you covered long before it's time to file a claim. But first, here's a closer look at whether Kentucky is a no-fault state and what that means.

What Is a No-Fault State?

A state's fault type refers to a driver's responsibilities after an auto accident if they were at fault or the victim. In a no-fault state, any driver who gets injured in a car accident can file a claim to get compensated for their injuries afterwards. The driver can file the claim right away regardless of whether they caused the accident or were the victim.

There are only 12 no-fault states in total. Fault states, however, deem that the driver who caused the accident is responsible for paying the costs of the victim's injuries or damage. The majority of the US states are categorized as fault states.

Is Kentucky a No-Fault State?

Actually, Kentucky is what's known as a "choice no-fault" state, which allows drivers the choice of opting out of the no-fault insurance system. If a driver opts out, they can press charges after an auto accident. However, the driver would then also be open to getting sued, themselves.

What Kind of Car Insurance Do No-Fault States Require?

Since Kentucky is a choice no-fault state, it mandates that its drivers carry personal injury protection (PIP) coverage under their auto insurance. PIP coverage pays for your injuries and injuries to your passengers after a crash, regardless of whether you're at fault. After an accident, Kentucky drivers are required to file a claim through their own auto insurance policy first, but then can request to opt out of the no-fault system.

Kentucky also requires drivers to have these types of car insurance:

- Bodily injury liability: Pays costs of another driver's injuries and lost wages if you cause an accident.

- Property damage liability: Pays costs of repairs to another driver's car or other property if you cause an accident.

- Uninsured or underinsured motorist: Helps reimburse you for bodily injury or property damage costs if you get into an accident with someone who does not carry any or adequate auto insurance.

A Kentucky independent insurance agent can help you get set up with all the auto insurance you need to protect yourself on the road.

What Are the Most Common Types of Car Accidents?

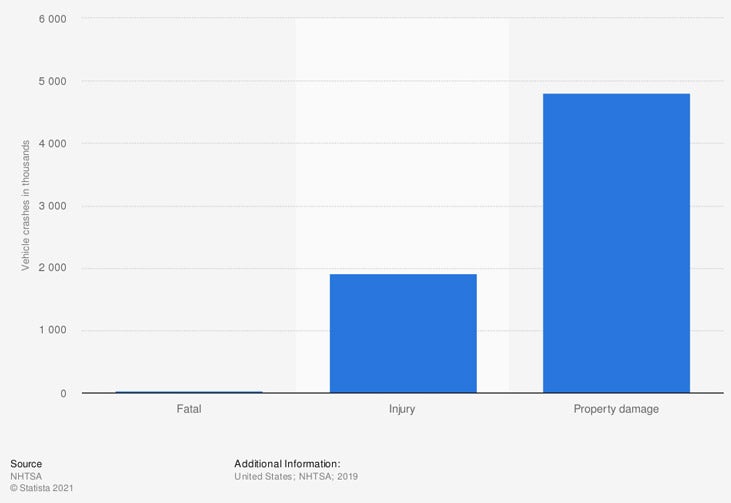

When considering which type of auto insurance you need, it's helpful to know the most common types of car accidents across the board. Check out these stats for car accidents in the US overall to see for yourself.

Vehicle crashes in the US by type

There were nearly 6.8 million car crashes in the US in a recent year. Of these, 1.9 million were injury crashes, and nearly five million were property damage crashes. Only about 33,000 crashes were fatal.

Since car accidents are so common, especially the type that damage property, it's crucial to work together with your Kentucky independent insurance agent to get set up with all the coverage you need.

What Other Kind of Car Insurance Do I Need in Kentucky?

It's always important to at least consider adding more than just your state's mandated car insurance coverages to your policy. To get the most complete picture of protection for yourself, your passengers, and your vehicle, you should also look into adding these coverages to your policy:

- Collision coverage: This covers the cost of damage to your vehicle if it gets hit by another driver.

- Comprehensive coverage: This protects your vehicle from many other threats, including collisions with large animals, windshield breakage, theft and vandalism, storm damage, and more.

A Kentucky independent insurance agent can help you review all your car insurance options to get you set up with all the protection you need.

What If I Don't Have Car Insurance in Kentucky?

Kentucky mandates that all drivers have insurance. If a driver fails to carry at least the state's mandated forms of coverage, their vehicle's registration can get revoked. There are also state fines of between $500-$1,000, and potential jail sentences of up to 90 days for driving without insurance.

Regardless of your state's laws about car insurance, it's never a good idea to go without coverage. Just one incident, whether it's a traffic accident, collision with an animal, or a storm, could potentially wreck your vehicle beyond repair. Without car insurance, you'd be left paying for a replacement out of your own pocket.

How a Kentucky Independent Insurance Agent Can Help You

Independent insurance agents are fully equipped to protect drivers against commonly faced disasters. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in car insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

nolo.com/legal-encyclopedia/kentucky-no-fault-car-insurance.html

davidbryantlaw.com/car-accidents/is-kentucky-a-no-fault-state/

hg.org/legal-articles/what-is-the-difference-between-no-fault-and-at-fault-insurance-states-35152

iii.org/automobile-financial-responsibility-laws-by-state

chart - statista.com/statistics/191499/vehicle-crashes-by-severity-in-the-united-states-since-1991/

© 2025, Consumer Agent Portal, LLC. All rights reserved.