Insurance Content Navigation

- What Is Earthquake Insurance?

- What Does Earthquake Insurance Cover in Kentucky?

- What Doesn't Earthquake Insurance Cover in Kentucky?

- How Much Is Earthquake Insurance in Kentucky?

- Does Homeowners Insurance Cover Earthquakes in Kentucky?

- Does Earthquake Insurance Cover Flooding in Kentucky?

- How a Kentucky Independent Insurance Agent Can Help You

What Is Earthquake Insurance?

Earthquakes may not be number one on the list of common occurrences in Kentucky, but coverage shouldn't be ignored. If an earthquake does happen here, then insurance would help pay for things like:

- Personal belongings

- Your dwelling

- Temporary housing costs

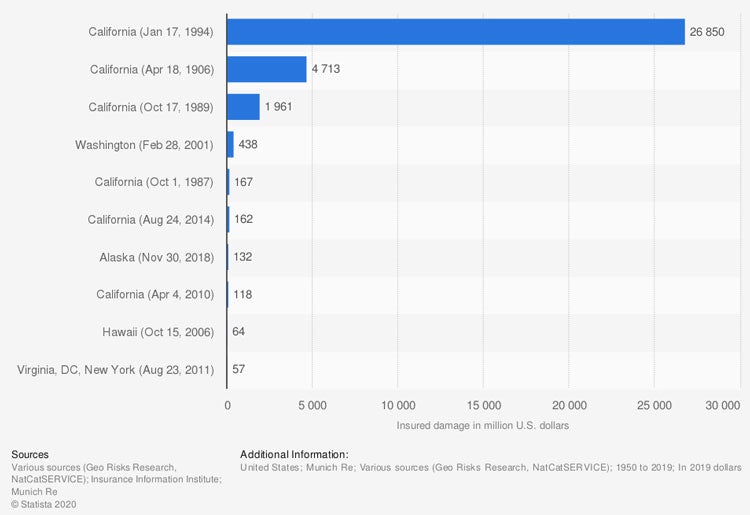

Most expensive earthquakes to the insurance industry in the United States as of 2019

Some earthquakes are more costly than others. While Kentucky may not be hit hard most of the time, it only takes one catastrophe to cause severe loss.

What Does Earthquake Insurance Cover in Kentucky?

Kentucky earthquake insurance is usually a separate coverage altogether. This policy will cover damage to your property and replace or repair accordingly. Most earthquake policies will cover the following:

- Dwelling limit: Pays for the replacement or repair of your property itself when an earthquake occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Additional living expenses: Pays for your temporary stay at another property when an earthquake makes your home uninhabitable.

What Doesn't Earthquake Insurance Cover in Kentucky?

Similar to any other insurance you have in Kentucky, your earthquake policy will have exclusions. The majority of earthquake coverage does not include the following:

- Your vehicles

- Your fence

- Your pool

- Your collectible items

- Damage to your land

- Flooding

Number of earthquakes worldwide, by Richter Scale gradation (magnitude)

Earthquakes can occur anywhere and often with no warning. If you're not protected, then you could have to account for the damage on your own.

How Much Is Earthquake Insurance in Kentucky?

In Kentucky, homeowners insurance cost run on average $1,109 per year. The premiums for your earthquake insurance will vary and depend on your risk factors. Take a look at what carriers use to calculate your earthquake insurance:

- Address

- Claims history

- Credit score

- Value of your property

- Coverage limits selected

Does Homeowners Insurance Cover Earthquakes in Kentucky?

Kentucky had 549,229,000 homeowners insurance claims paid in one year alone. Earthquake coverage can usually be included or added to your home policy for an extra fee. The limits of protection will be preselected by you and your agent.

Does Earthquake Insurance Cover Flooding in Kentucky?

If an earthquake causes a flood to occur on your property, then you could be exposed. Anything flood-related is typically only insured under a flood insurance policy. If you're without separate flood insurance for your Kentucky home or business location, then you could have a large expense on your hands.

How a Kentucky Independent Insurance Agent Can Help You

Your Kentucky personal and business insurance are important, and can be tricky when you're not a licensed adviser. Protection for an earthquake is often overlooked in lower-risk states, which can leave you exposed. Fortunately, a trusted professional can help you review your coverage for free.

A Kentucky independent insurance agent does all the shopping through their network of carriers. This means you have options on policy and price. Connect with a local expert on TrustedChoice.com for tailored quotes to get started.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/276732/the-most-expensive-earthquakes-for-the-insurance-industry-in-the-united-states-since-1980/

Graphic #2: https://www.statista.com/statistics/263104/worldwide-earthquakes-since-2006-by-richter-scale-gradation/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.