Flooding is a risk that may severely impact 13% of Kentucky properties over the next 30 years. One way to be prepared for a flood is to understand your risk and how your insurance can provide financial assistance.

Flood insurance is separate from standard homeowners insurance, so the easiest way to ensure that you're fully protected is through a Kentucky independent insurance agent. Agents can secure your coverage and answer any questions about coverage.

Where Is Flooding Most Common in Kentucky?

Certain geographic areas and types of landscape are more susceptible to flooding. For Kentucky homeowners, living near river lines, creeks, and streams can increase your risk of flooding. Because of the state's varying types of topography, a surge in rain can easily lead to flash flooding, impacting the terrain around these bodies of water.

As a homeowner, your agent can help determine if your home is at risk of flooding. Insurance companies are well-versed in locations around the state that are more prone to flooding, and your agent can help you determine if you're in a risky enough area to warrant flood insurance.

Do I Need Flood Insurance in Kentucky on Top of Home Insurance?

Kentucky home insurance does not include damage from natural flood waters. Therefore, if you and your agent determine that your home is at risk of flooding, you need an additional flood insurance policy. Flood insurance is sold separately from home insurance and is mainly provided through the National Flood Insurance Program. You must work with a licensed insurance agent to purchase flood insurance through the NFIP.

You can also purchase private flood insurance from individual companies. However, their policies tend to be more expensive.

Some homes in Kentucky are required to carry flood insurance. If a home is located in a high-risk flood zone and you have a federally regulated loan, you'll be required to have flood insurance.

Flood insurance can still be beneficial even if your home is located in a low- to moderate-risk area. You can use preliminary maps to determine whether your home is located in a flood zone or not.

What Does Flood Insurance Cover?

Flood insurance covers your home and your stuff if natural waters damage them. Covered events include severe storms, waves, broken dams, snowmelt, raised river levels, and other events that cause water to rise from the ground up. Flood insurance is split into two coverages, building coverage and contents coverage.

Example of building coverage included in flood insurance:

- Electrical and plumbing

- Foundation

- HVAC equipment

- Appliances

- Permanently installed carpet over an unfinished floor

- Debris removal

Example of contents coverage included in flood insurance:

- Furniture

- Electronics

- Clothing

- Washers and dryers

- Dishwashers

- Valuables such as art/jewelry

Flood insurance factors in depreciation, so personal items are reimbursed at their current value, not what you paid for them.

How Much Does Flood Insurance Cost in Kentucky?

Flood insurance costs are based on several factors, including whether you purchase through a private carrier or through the NFIP, your location, your risks, and how much coverage you need. Recently, the Federal Emergency Management Agency (FEMA) announced it will be adjusting how homeowners are charged for flood insurance through the NFIP.

The new pricing system, Risk Rating 2.0, will consider a variety of factors when determining a home's flood risk.

- Actual flood risk of the individual home

- Foundation type

- Height of lowest floor

- Replacement cost of the structure

Ultimately, the agency is using individual flood risks to help determine pricing, which they say will provide homeowners with more affordable flood insurance coverage.

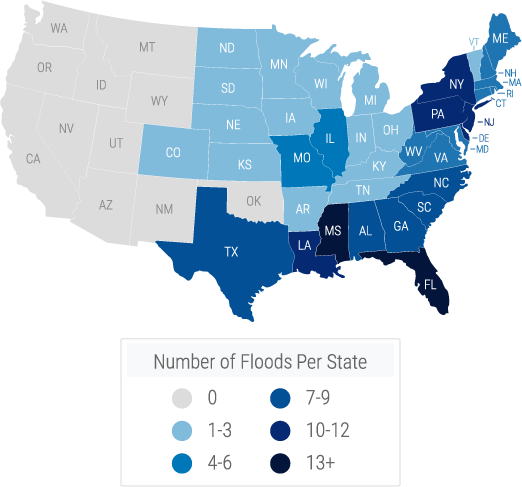

How Common Is Flooding in Kentucky?

Kentucky experiences more flooding because of the state's topography than you may think. Here are some stats on how common flooding is in the state and the type of damage it can cause.

- Flooding is the number one most frequent and costly disaster in Kentucky.

- 13% of properties in Kentucky are at risk of flooding over the next 30 years.

- Louisville's estimated annual precipitation has increased 7% in recent years.

- Kentucky has experienced 100 flood-related deaths since 1996.

- More than 4% of flood-related deaths that have occurred in the US have occurred in Kentucky.

How Can a Kentucky Independent Insurance Agent Help?

Flooding is not a unique risk to homeowners, but it is a unique type of coverage that a Kentucky independent insurance agent can help you secure. If you need flood insurance, an agent can ensure that you're set up with the right policy and policy limits. Work with an agent to compare flood insurance costs and coverages in your area.

Article reviewed by | Jeffrey Green

https://www.courier-journal.com/story/weather/local/2021/10/15/kentucky-flood-risk-among-highest-united-states-report-finds/6093812001/

https://www.floodsmart.gov/whats-covered

https://sgp.fas.org/crs/homesec/R45999.pdf

https://www.weather.gov/jkl/flooddeathhistory

https://eec.ky.gov/Environmental-Protection/Water/FloodDrought/Documents/KentuckyFloodFactSheet.pdf