Insurance Content Navigation

- Does Kentucky Homeowners Insurance Cover Tornado Damage?

- Does Kentucky Car Insurance Cover Tornado Damage?

- Common Tornado Damage Claims

- How Much Does Tornado Insurance Cost in Kentucky?

- Is Tornado Insurance Required in Kentucky?

- How a Kentucky Independent Insurance Agent Can Help You

Tornados might not be the biggest weather threat to Kentucky, but Western Kentucky is part of the infamous area known as Tornado Alley, and the state still experiences an average of 21 tornados a year. When a tornado strikes it brings with it high winds, which can result in costly damage to your home, assets, and vehicles. That's why it's important to understand if you need tornado insurance and how to know if you already have it in your homeowners insurance.

A Kentucky independent insurance agent can help you understand your home's risk for tornado damage and assist in making sure you're properly protected if you're at risk.

Does Kentucky Homeowners Insurance Cover Tornado Damage?

Most homeowners insurance policies cover damage from wind or hail, which includes tornado damage. However, this is not the case for every policy for every person. If your policy excludes wind damage, then you need to request tornado coverage as an additional rider to your policy.

Typically, your home is covered under your dwelling coverage, while the belongings inside your home are covered by your personal property coverage. Should either be damaged by wind from a tornado, then these coverages would pay to repair or replace the damage.

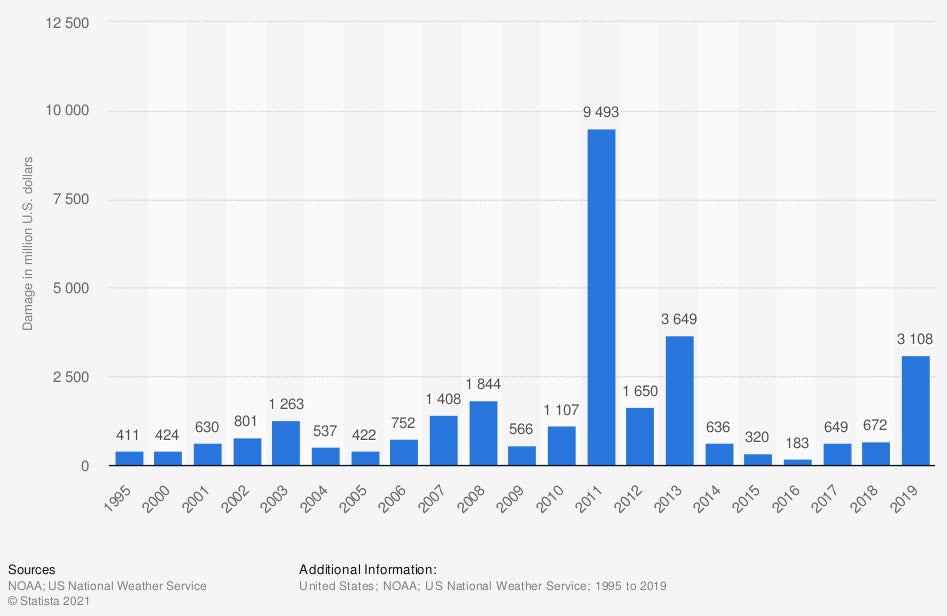

Your Kentucky independent insurance agent can tell you whether your current homeowners policy includes tornado coverage. Most of the time, it will be included, but what's more important is making sure that you have sufficient coverage if disaster strikes. You can see in the graph below that damage from a tornado can be costly.

Economic damage caused by tornadoes in the U.S. , 1995-2019

(in million U.S. dollars)

In 2019, tornadoes resulted in approximately $3.1 billion in damage across the United States.

Does Kentucky Car Insurance Cover Tornado Damage?

If your vehicle is damaged in a tornado, insurance will only pay to repair or replace your vehicle if you've purchased comprehensive insurance coverage. Comprehensive coverage is not required for drivers in Kentucky but is a valuable policy to have. According to insurance expert Paul Martin, there are many ways your vehicle can be damaged. "Comprehensive coverage is designed to protect you against everything that could happen that's not a collision. Think about all of the ways your car could be damaged: tornado, flood, fire, theft, and vandalism. If you're at risk for any of these events, then you want comprehensive coverage."

The only time that comprehensive insurance does not make sense is if the value of your vehicle is less than the cost of your car insurance premium.

Common Tornado Damage Claims

Tornados are violently rotating columns of air that sweep quickly across the land, destroying anything in their path. They have the power to break windows, rip off roofs, lift vehicles off the ground, tear down power lines, and destroy entire buildings. They are often accompanied by rain or hail. The combination of power and weather patterns is what makes a tornado so dangerous. There are a variety of common claims that are made related to tornado damage, including:

- Hail damage

- Wind damage

- Flying debris

- Flying trees

- Lightning

- Downed power lines

Tornados can even cause flooding, but flood insurance is purchased separately from tornado insurance.

How Much Does Tornado Insurance Cost in Kentucky?

If wind and hail damage is included in your homeowners insurance, then the cost for tornado coverage is whatever your home insurance cost is. For Kentucky residents, the average home insurance premium is $1,109 annually. If you need to add wind and hail damage coverage to your insurance, you can expect your premium to increase slightly. Insurance carriers will consider a number of factors when creating your home insurance policy, such as location, home value, how your home was built, and its risks for damage. This means that a house that's located in Tornado Alley will most likely cost more to insure for tornado damage than one that is not.

The other expense that could increase your insurance cost is adding to your tornado coverage amount. It's important to have sufficient coverage, and you may want to increase the amount of coverage you have. You can work with your independent insurance agent to do this.

Is Tornado Insurance Required in Kentucky?

Since tornados are usually classified as windstorms by insurance companies, insurance for them is not required by states. However, just because it's not required doesn't mean that it's not worth having. If your home is at any risk of being hit by a tornado, you want to make sure it's covered in your homeowners policy. If you have multiple vehicles, you may also want to consider purchasing comprehensive car insurance so that they are covered as well. At the end of the day, it's better to be safe than sorry when it comes to tornado damage.

Why it's important to know if your Kentucky home insurance covers tornados:

- Kentucky ranks 15 in the US for number of tornado-related deaths.

- The cost of tornado-related repairs in Kentucky is estimated to be upwards of $300 million.

- The majority of Kentucky’s tornados are F0-F1 on the Fujita scale.

- April is Kentucky’s peak month for tornados.

How Can a Kentucky Independent Insurance Agent Help?

Tornados are one of the costliest disasters that can strike a city. Whether you live in Western Kentucky's Tornado Alley or not, your home might be at risk. Understanding your homeowners insurance and whether it includes wind and hail damage will help prepare you for any potential tornado risks you face. Working with a Kentucky independent insurance agent makes it easy to get the process started. They can review your existing policy, discuss your tornado coverage, and help you determine whether you need more. They can also review your policy every year to make sure you have the best coverage possible. If you need to increase or decrease your coverage, or shop for new insurance, they'll do the hard work and find you the best deal for your needs.

Article Author | Sara East

Article Reviewed by | Paul Martin

https://www.groundzeroshelters.com/kentucky-tornado-facts

statista.com

https://www.ncdc.noaa.gov/climate-information/extreme-events/us-tornado-climatology

© 2025, Consumer Agent Portal, LLC. All rights reserved.