When livestock is part of your livelihood, you'll want sufficient protection that won't break the bank. While living on a ranch can be exciting and fun, adequate coverage is necessary to keep it running smoothly. Kentucky commercial insurance will have coverage for your cattle ranch so that you're prepared.

Fortunately, a Kentucky independent insurance agent has access to multiple carriers at once, saving time and presenting the best options. They'll even do the shopping for you, letting you focus on your business. Get connected with a local expert to get started in minutes.

What Does Cattle Ranch Insurance Cover In Kentucky?

It's vital to have a general knowledge of what's covered under your Kentucky cattle ranch insurance. The proper protection starts with knowing your policies and how your cattle are insured.

What your cattle ranch insurance generally covers:

- Accidents: This can be anything from coverage for electrocution, fire, and smoke, to loading and unloading livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Floods and earthquakes are typically covered under separate policies.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

- Collision or other death while transporting: This is in-transit coverage for your livestock.

What Doesn't Cattle Ranch Insurance Cover In Kentucky?

If you have a loss that's not covered, you could be out thousands of dollars or worse. When it comes to your cattle, your policies will have exclusions just like anything else.

There is typically an endorsement or included coverage, depending on the carrier, for the following:

- Accidental shooting

- Drowning

- Attack by wild animals

- The collapse of a building on livestock

Your livestock insurance will generally not have an option to add a few specific exposures. If your cattle are affected by old age, death by natural causes, or disease, insurance usually won't foot the bill.

How Much Livestock is Covered under Kentucky Cattle Ranch Insurance?

Accidents or diseases of your livestock can come on fast and affect your livelihood. In Kentucky, cattle ranch insurance applies on an individual, blanket, or herd-specific basis for your cattle. Check out the three ways to cover your animals:

- Individual coverage: This insurance usually covers higher-value animals on an individual basis. The animals are listed on the policy and covered for a specific dollar amount.

- Blanket coverage: This type of policy allows you to insure all your farm property for a predetermined value. It includes structures, equipment, tools, and livestock.

- Herd coverage: This is the simplest and most prevalent type of insurance for livestock. This coverage allows you to insure a specific number of animals.

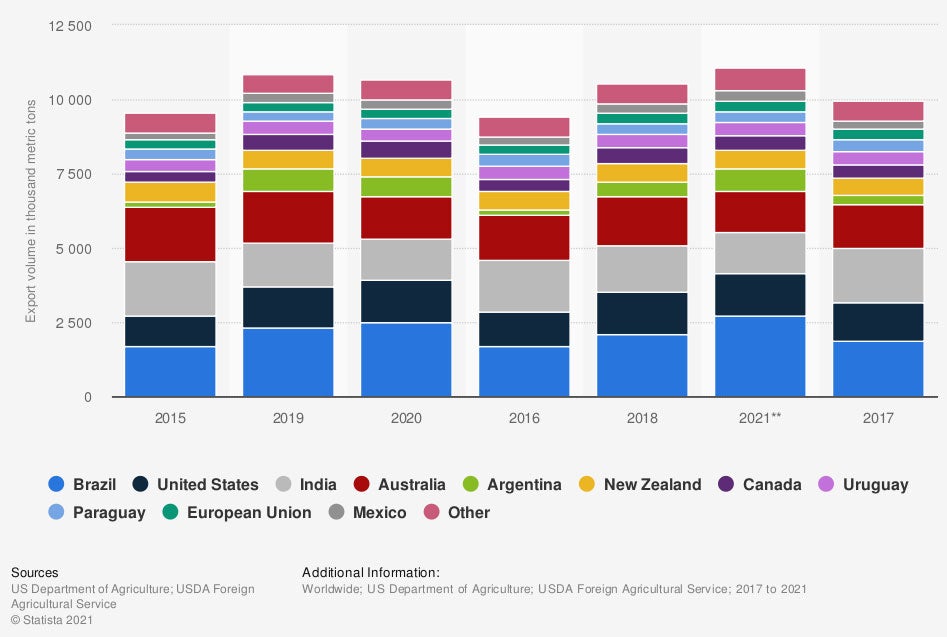

Export volume of beef and veal worldwide from 2017 to 2021, by country (in 1,000 metric tons)

The cattle you own are a vital piece for your Kentucky cattle ranch. The right coverage can be purchased for a fair price if you know where to look.

How Much Is Cattle Ranch Insurance In Kentucky?

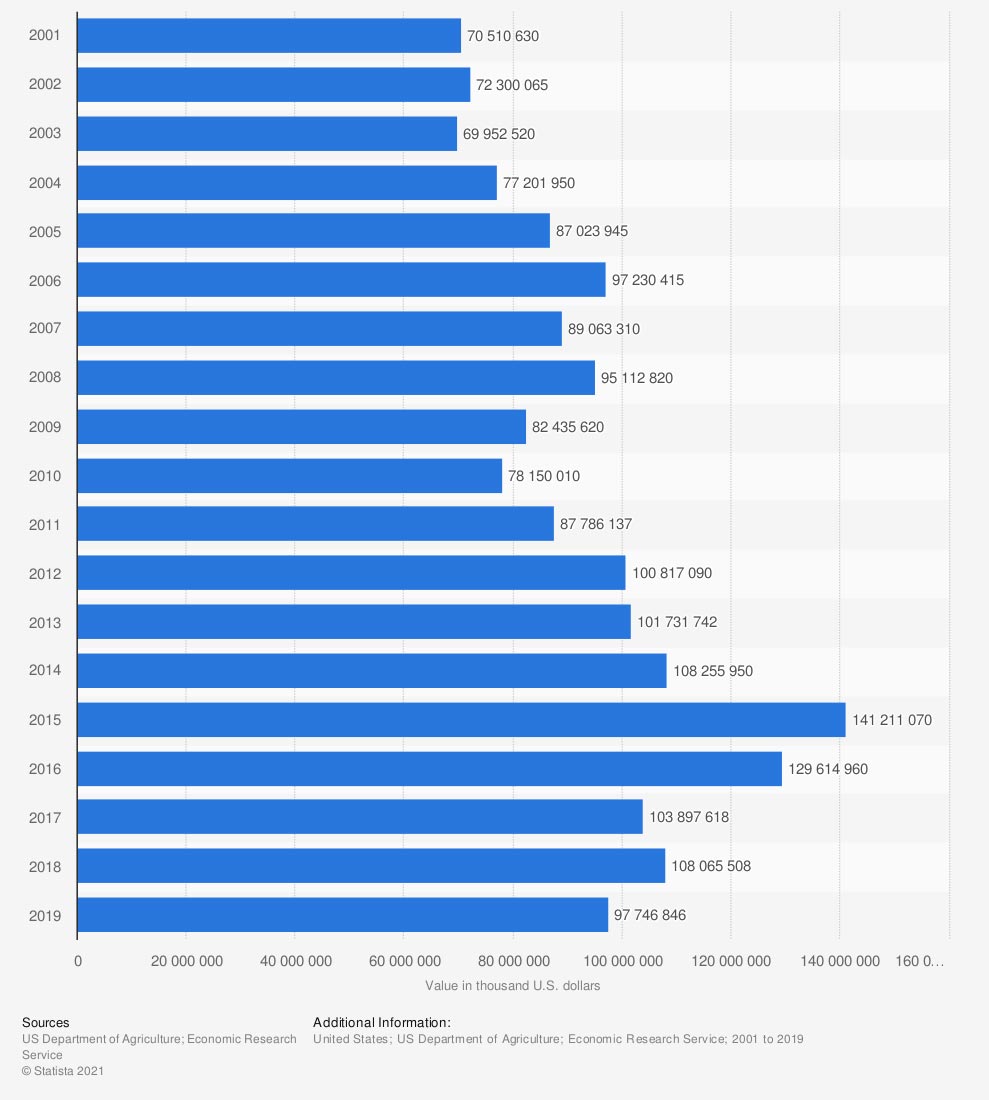

The total value of cattle and calves in the US is over $90 million dollars. If you own a cattle ranch in Kentucky, you'll be responsible for sufficient coverage in the event of a loss.

Total value of all cattle and calves in the US from 2001 to 2019 (in thousand US dollars)

If you lose one animal, it may not impact your business too much, but losing an entire herd could put you in a bad spot. The premium to insure cattle will be different for every rancher, and based on their individual needs. Some factors that affect premium are as follows:

- What is your livestock worth?

- How is the health of your livestock?

- How is your livestock managed and maintained?

- Have you reported any prior claims on your herd?

Do I Need Specific Liability Coverage for My Kentucky Cattle Ranch?

Every policy will start with a general liability policy in some form. Lawsuits for bodily injury or property damage are among your biggest exposures when you own a cattle ranch in Kentucky. Check out the different liability options you'll have:

- General liability insurance: This is your primary policy and will pay for a lawsuit arising from bodily injury, property damage, or slander.

- Commercial umbrella insurance: This liability coverage will go above and beyond your underlying policies and extend protection starting at $1,000,000.

- Product liability insurance: If you sell products such as cattle or meat, this coverage will help protect you from a lawsuit arising from a loss involving products you sold to a client.

How a Kentucky Independent Insurance Agent Can Help

If you own a cattle ranch in Kentucky, you'll be responsible for everything that could go wrong. The right insurance for your herd and daily operations can be daunting if you're not a licensed adviser. Fortunately, a trusted professional can review your policies for free.

A Kentucky independent insurance agent has access to a network of carriers so that you're getting the best coverage. They can shop premiums with multiple markets, giving you rates that fit your budget. Connect with a local expert on TrustedChoice.com for custom quotes today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/617458/beef-and-veal-export-volume-worldwide-by-country/

Graphic #2: https://www.statista.com/statistics/194292/total-value-of-cattle-and-calves-in-the-us-since-2001/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.