Insurance Content Navigation

- What Is Comprehensive Car Insurance?

- What Does Comprehensive Insurance Cover in Kentucky?

- What Doesn't Comprehensive Insurance Cover in Kentucky?

- Kentucky Comprehensive Insurance vs. Collision Insurance

- Is Comprehensive Car Insurance Required in Kentucky?

- How Much Does Comprehensive Insurance Cost?

- How a Kentucky Independent Insurance Agent Can Help You

Kentucky is home to nearly 80,000 miles of roadways, but on the road isn't the only place your vehicle is at risk. Even parked in your driveway or at work, you run the risk of theft, vandalism, or being damaged by a fire or flooding. That's why it's important to have a car insurance policy that protects you against any of these risks.

For damage that can happen to your vehicle when you're off the road and even on it, you need comprehensive insurance coverage. A Kentucky independent agent can help you determine if comprehensive insurance is right for you and where to find it.

What Is Comprehensive Car Insurance?

Comprehensive car insurance is an optional auto insurance policy that helps pay to repair or replace your vehicle if it's damaged by something other than a collision with another car or object.

It's often referred to as "other than collision" insurance because it's designed to cover everything that would not fall under a collision.

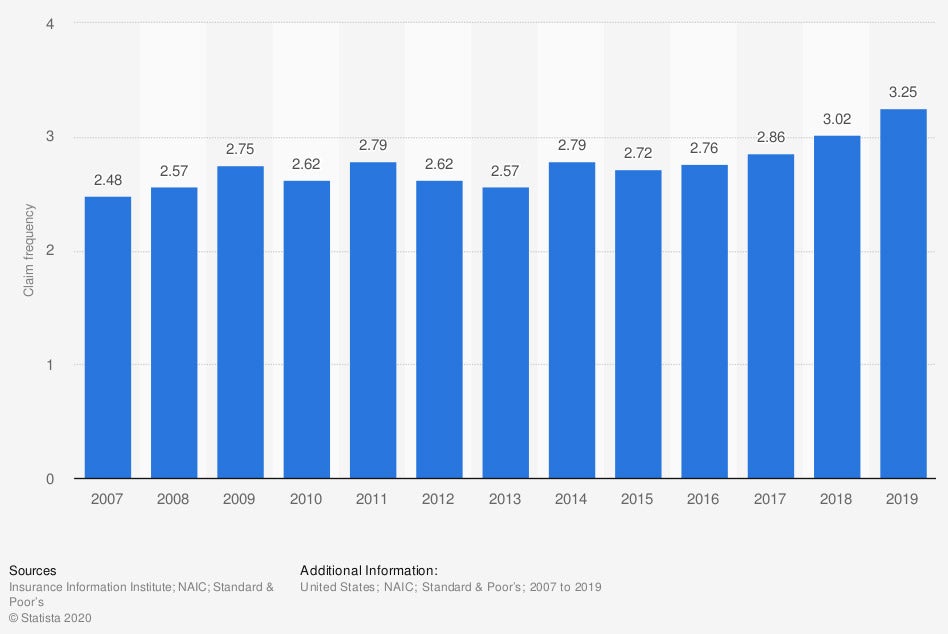

Frequency of private passenger comprehensive auto insurance claims for physical damage in the United States from 2013 to 2019

In 2019, there were 3.25 private passenger comprehensive auto claims for physical damage filed in the United States per 100 car years.

What Does Comprehensive Insurance Cover in Kentucky?

If your vehicle is damaged by anything other than a collision, it will be covered under your comprehensive insurance. This includes things like:

- Theft: Covers replacement if your car is stolen.

- Vandalism: Covers repairs if your car is keyed or experiences graffiti.

- Flood: Covers repair and replacement if your car is flooded.

- Fire: Covers repair and replacement if your car is damaged by wildfires, house fires, and other red-hot emergencies.

- Severe weather: In case of hail, tornadoes, hurricanes, and other natural disasters.

- Animal accidents: Covers repair and replacement if you hit a deer, skunk, cow, or another animal.

- Riot: Covers damage or repair if your car is caught in a riot.

- Glass breakage: Covers repairs to your windshield and windows in case of damage.

Your Kentucky independent agent can help you determine if comprehensive insurance is a good addition to your existing policy.

What Doesn't Comprehensive Insurance Cover in Kentucky?

There are some incidents where comprehensive insurance won't cover the damage to your vehicle. These include:

- Collision with another vehicle or object: This is covered under your Kentucky collision insurance.

- Damage caused by road surfaces: If you run over a pothole or crack in the road and it damages your vehicle.

- Towing: If you have to get your vehicle towed after a breakdown or flat tire.

- Personal possessions inside the vehicle: If your vehicle is broken into and someone steals your laptop off the front seat, it will not be covered.

- Use of a rental car: If your car is being fixed and you need to rent a car, you will need additional rental car coverage in order for it to be covered.

Personal belongings can be covered under your homeowners insurance policy or personal contents insurance.

Kentucky Comprehensive Insurance vs. Collision Insurance

Both comprehensive and collision insurance are optional insurance options for Kentucky drivers. However, they are both valuable in their own way. We've already discussed the benefits of comprehensive insurance and how it protects you from different things than collision insurance.

Collision insurance is important because it will help pay for damage or vehicle replacement if you're in an at-fault accident with another vehicle or object. This means rear-ending someone, colliding with someone, running into a pole or fence, or even a building. Colliding with another object or vehicle can result in costly damage to your vehicle. If you're the at-fault driver, then you're the person responsible for those charges. The same goes for comprehensive insurance, since the list of coverages is all events that don't require another person to be involved.

Even though they're not required in Kentucky, comprehensive and collision insurance are highly beneficial for many drivers. An independent agent can help you compare policies and determine if either or both of these options are good for you.

Is Comprehensive Car Insurance Required in Kentucky?

Comprehensive car insurance is not required in Kentucky. The state only requires that you have liability insurance, which includes bodily liability and property liability damage coverage. It also requires personal injury protection.

Just because comprehensive insurance isn't required doesn't mean it's not valuable coverage. Your vehicle faces a variety of unexpected risks, even when it's parked. If your vehicle has a high value and is fairly new, it's almost always a good idea to get comprehensive insurance coverage.

How Much Does Comprehensive Insurance Cost?

Policies and premiums are personalized for you and your vehicle and to provide ample coverage against certain risks. The final premium will be based on the following factors:

- Car value: The more expensive your vehicle, the more it will cost to repair or replace. This impacts the cost of your premium.

- Safety record: If you have multiple crashes and things like a DUI on your record, it will increase your insurance costs all around.

- Experience and age: Insurance companies don't like young drivers because they tend to get in more accidents. Traditionally, people under the age of 25 have more expensive insurance.

- Location: Different regions (called "rating territories”) have different risks that affect costs. Drivers in congested cities are likely to pay more for insurance because heavy traffic is a risk factor for accidents, even if you’re a good driver otherwise.

The average cost of car insurance in Kentucky is $1,341. Adding comprehensive coverage could cost as little as $600 a year or be several thousand, depending on your situation.

How a Kentucky Independent Insurance Agent Can Help You

You have many options when it comes to companies and policies to purchase car insurance. A Kentucky independent agent is an expert in car insurance and shopping different deals. They can pull quotes from multiple carriers and walk you through your options and the coverage to see which is the best fit for you. They're not just there in the beginning either. Should you find yourself in need of filing a comprehensive insurance claim, they can help you through the process. Find an insurance agent today.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.iii.org/article/what-is-covered-by-collision-and-comprehensive-auto-insurance

statista.com

https://transportation.ky.gov/HighwaySafety/Pages/default.aspx

© 2025, Consumer Agent Portal, LLC. All rights reserved.