When you own a storefront, it can be fun setting up shop and catering to your local community. As a business owner, there are multiple risk scenarios you'll have to take into account. Convenience store insurance can be obtained under your Kentucky commercial insurance policies.

Fortunately, a Kentucky independent insurance agent has access to a network of markets so that you have options. Coverage and premiums are essential when you own a business, and a trusted adviser can help. Connect with a local expert for custom quotes today.

What Is Convenience Store Insurance?

Your Kentucky convenience store insurance will have multiple policies and coverage options. However, there are standard policies every business owner will need, whatever the industry. Check out some common coverage choices for convenience stores below:

- General liability: Pays for a claim for bodily injury or property damage.

- Business property: Pays for the repair or replacement of your business property.

- Business inventory: Pays for the repair or replacement of your business inventory.

- Commercial umbrella liability: Pays for a substantial liability claim when your underlying limits have been exhausted.

- Workers' compensation: Pays for the medical expenses and lost wages of an employee who gets injured or becomes ill on the job.

- Employment practices liability: Pays for a discrimination lawsuit brought by an employee.

Convenience store sales worldwide from 2017 to 2022 (in trillion US dollars)

When you own a convenience store in Kentucky, you'll likely be met with competition. To stay ahead of the curve and protect your livelihood, you need to purchase the right coverage.

What Does Convenience Store Insurance Cover In Kentucky?

In Kentucky, there are currently 351,260 small businesses in existence. Every operation will have basic policies, and a convenience store is no different. Let's look at common convenience store coverages:

- Coverage for claims of bodily injury or property damage

- Coverage for your business inventory, such as merchandise

- Coverage for business equipment that breaks down due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

Your convenience store insurance will typically come with protection against primary perils automatically. This will include fire, natural disasters, theft, vandalism, and some water damage.

How Much Is Convenience Store Insurance in Kentucky?

All commercial insurance premiums will vary by industry type and a business's specific characteristics. In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. You'll want to be sure you have the right coverage for a fair price. Take a look at the risk factors carriers use when quoting:

- Loss history

- Replacement cost values

- Insurance score

- Experience level

- Local crime rate

- Local weather patterns

How Much Merchandise Is Covered under Kentucky Convenience Store Insurance?

The selling and buying of goods make up the bulk of your livelihood. Protection for your merchandise and inventory are covered under your Kentucky commercial property and inventory insurance.

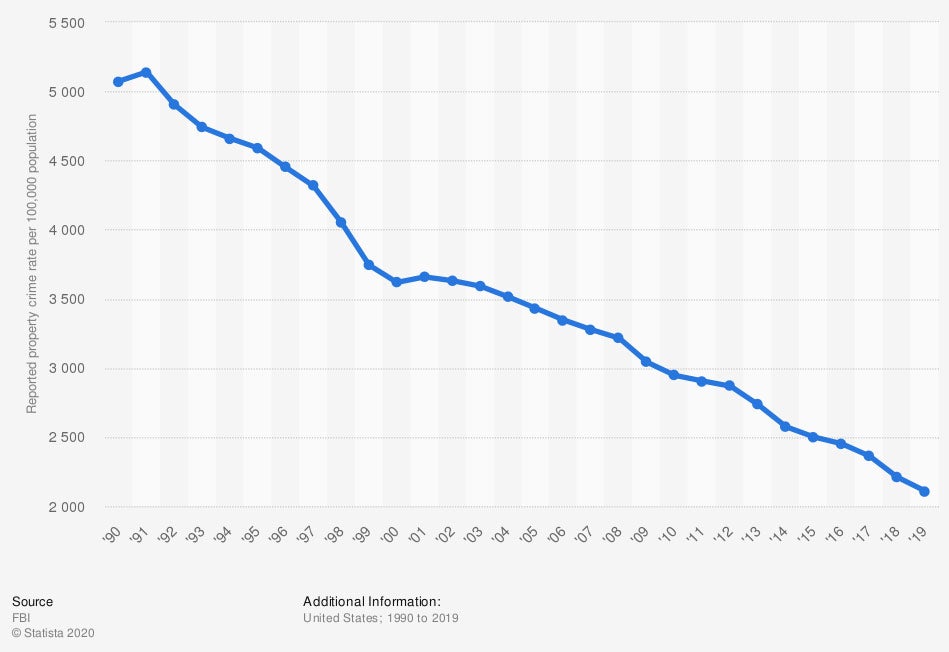

Reported property crime rate in the US from 1990 to 2019

If an item gets damaged or stolen, then your insurance will have coverage for theft and vandalism. This can occur a lot when you own a convenience store, and limits will need to be sufficient for accurate coverage.

Will My Kentucky Location Impact My Rates?

Carriers in Kentucky will look at where your convenience store is located as one of their rating factors. The local crime rate reported, weather losses, and flood zones will play a role in your insurance coverage. If your store is set up in a high-risk area or a zone prone to flooding, then your rates will likely be more expensive. Check with a licensed professional to see how your location will impact your coverage.

How an Independent Insurance Agent Can Help In Kentucky

When you're shopping for commercial insurance, coverage can be confusing if you're not a trained adviser. There are several policy options for your Kentucky convenience store that you won't want to miss. It can be challenging to know what's right for your business without proper help.

Fortunately, a Kentucky independent insurance agent will have access to a network of carriers so that you're presented with the best coverage for a fair price. They'll even do the shopping for you at no additional cost. Get connected with a local expert on TrustedChoice.com to start saving today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/study/22782/convenience-stores-in-the-us-statista-dossier/

Graphic #2: https://www.statista.com/statistics/191237/reported-property-crime-rate-in-the-us-since-1990/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.