When you own a company, it can be exciting and fun to serve the community around you. However, numerous risk factors come with every operation. Kentucky business insurance will have an option for cyber liability insurance so that you're entirely protected.

Fortunately, a Kentucky independent insurance agent can help you find coverage for an affordable price. They'll shop with multiple carriers at once so that you have options. Get connected with a local expert for custom quotes today.

What Is Cyber Liability Insurance?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. Cyber liability insurance can help your business avoid a substantial financial loss or worse. Check out how it works below:

- Cyber liability insurance: Pays for your legal, defense, and settlement costs when sensitive employee or client data is compromised virtually. It will also pay for notification expenses to the public and customers when a cyberattack occurs.

What Does Cyber Liability Insurance Cost in Kentucky

Cyber liability insurance costs will be different for every business. Your premiums will have more to do with what industry you are in and several other risk factors. Take a look at what carriers use to calculate your premiums:

- Gross annual income

- Cyber protection plans in place

- Updating of software

- Type of data stored

- Access points to data

- Malware used

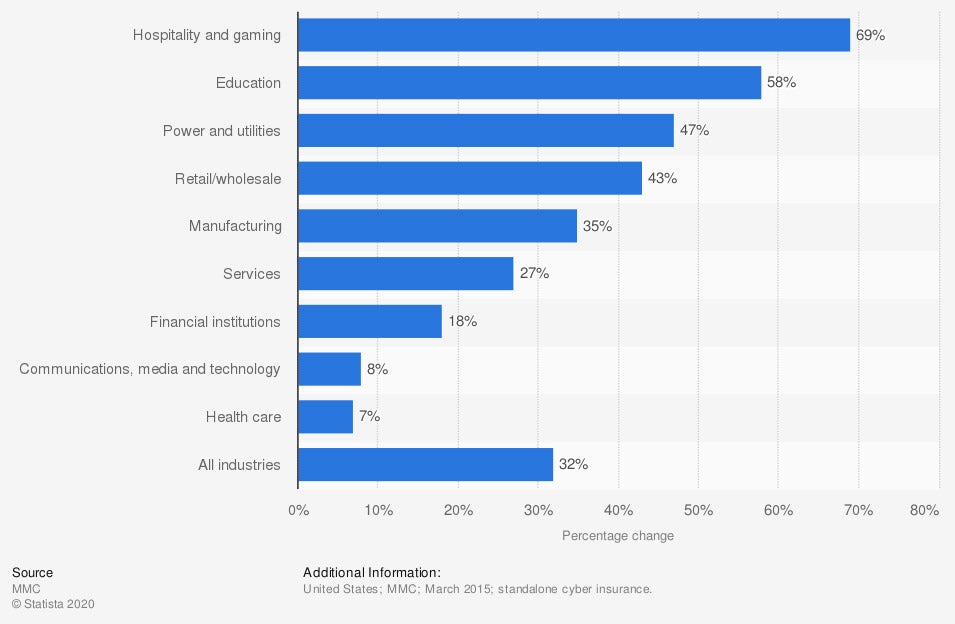

Change in number of companies purchasing standalone cyber insurance in the US from 2013 to 2014, by industry

A lot of companies see the importance of cyber liability protection. With the vast majority of businesses using technology in their daily tasks, it's essential to have coverage.

Who Needs Cyber Liability Insurance in Kentucky?

Most businesses in Kentucky will need cyber liability insurance. When a cyberattack occurs, you could be out a substantial amount of money without proper coverage. Check out when cyber liability insurance is most helpful:

- If you own a business

- If you use email or have internet

- If you utilize software

- If you obtain client or employee data electronically

Cyber Liability and Data Breach Insurance in Kentucky

Your Kentucky cyber liability insurance will be split into two different coverages. The first limit speaks to informing the public of a data breach. The second limit helps pay for any legal fees when a loss occurs. Take a look at how it works:

- Data breach insurance: Will apply when you have a breach of data, and you need to restore what was compromised. Coverage can be in the form of alerting the public of breaches, fraud alerts, identity restoration, consulting services, and more. This coverage is utilized first in the claims process.

- Cyber liability insurance: Will apply when an employee, client, or member of the public files a lawsuit. The lawsuit is due to the data breach that occurred and any sensitive information that may have been stolen. Cyber liability will pay for defense and settlement costs of a loss.

Cyber Liability Insurance for Law Firms in Kentucky

When you have a Kentucky law firm, you'll have sensitive data to the max. Cyber liability coverage will help protect attorney-client privilege and more. Check out what it will assist law firms with:

- Attorney fees

- Defense fees

- Settlement fees

- Informing the public

- Informing your clients

Cyber Liability Insurance for Small Businesses in Kentucky

In Kentucky, there are 351,260 small businesses in existence. A substantial loss could cause your company to go under without proper insurance. Here are some reasons why you'll need cyber liability coverage if you're a small business:

- You may not have the cash flow to pay for a loss out of pocket

- Legal fees could wipe out your reserves

- There could be multiple lawsuits filed against you for one incident

- Informing the public can cost additional funds you don't have

- It will keep your business operational during a lengthy legal battle

- It can help restore your stolen data

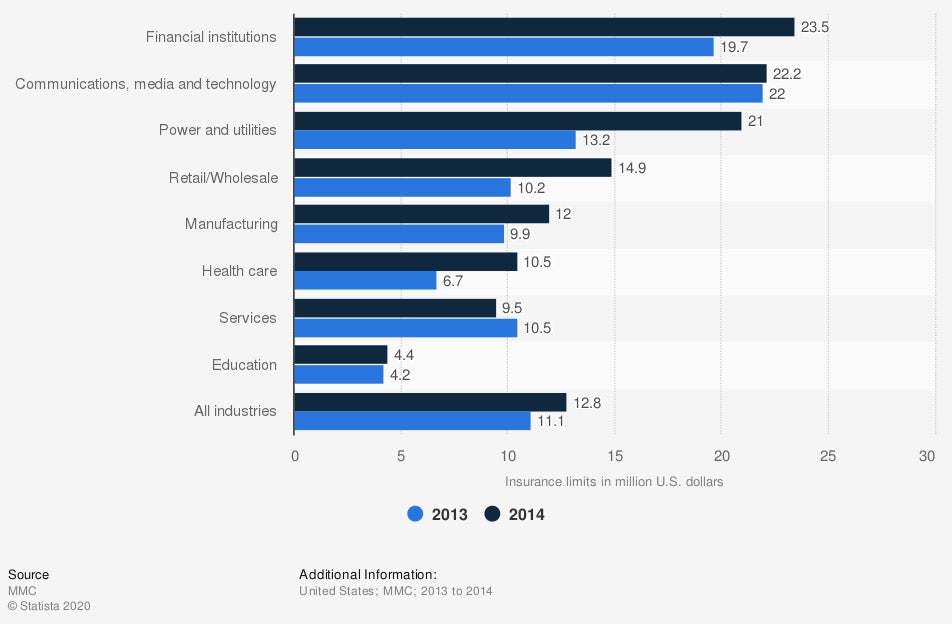

Average cyber liability insurance limits purchased in the US from 2013 to 2014, by industry

The limits that your company selects for cyber liability coverage may be different from those of another operation. It can depend on your industry and the exposures that you have.

Cyber Liability Insurance for Technology Companies in Kentucky

As a technology company in Kentucky, you'll have some of the highest premiums for cyber liability coverage. That's due to the amount and types of information you handle regularly. Check out why cyber liability insurance is essential for a technology company:

- It will pay for your legal fees if a lawsuit arises from a data breach.

- If your client gets hacked due to a system you implemented, this coverage, along with your other insurance policies, may respond.

- When you're dealing with other people's sensitive data, your company may be targeted by online predators.

Get a Kentucky Independent Insurance Agent in Minutes

In Kentucky, your business needs protection from all that comes its way. A trusted adviser can help you find coverage for free. They'll make sure you have cyber liability insurance that fits your operation and budget.

When you connect with a Kentucky independent insurance agent, you'll have the best options on policy and price. Since they have a network of carriers, you'll save big time. Find a local expert on trustedchoice.com in minutes at no cost to your business.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/423184/cyber-insurance-purchase-growth-rate-usa-by-industry/

Graphic #2: https://www.statista.com/statistics/422540/average-cyber-liability-insurance-limits-purchased-by-industry-usa/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.