In Kentucky, there are roughly 351,260 small businesses in existence. When you have a hair salon, you're in a fashionable industry that is everchanging. Fortunately, you can protect what you've built with Kentucky business insurance for your hair salon.

A Kentucky independent insurance agent will have access to multiple markets so that you're fully insured. They'll even do the shopping for free, saving you time and money. Get connected with a trusted expert and start saving today.

What Is Hair Salon Insurance?

If you own a hair salon in Kentucky, the right coverage is necessary to avoid a significant loss. You can obtain protection for your liability, property, and employee exposures through a local adviser.

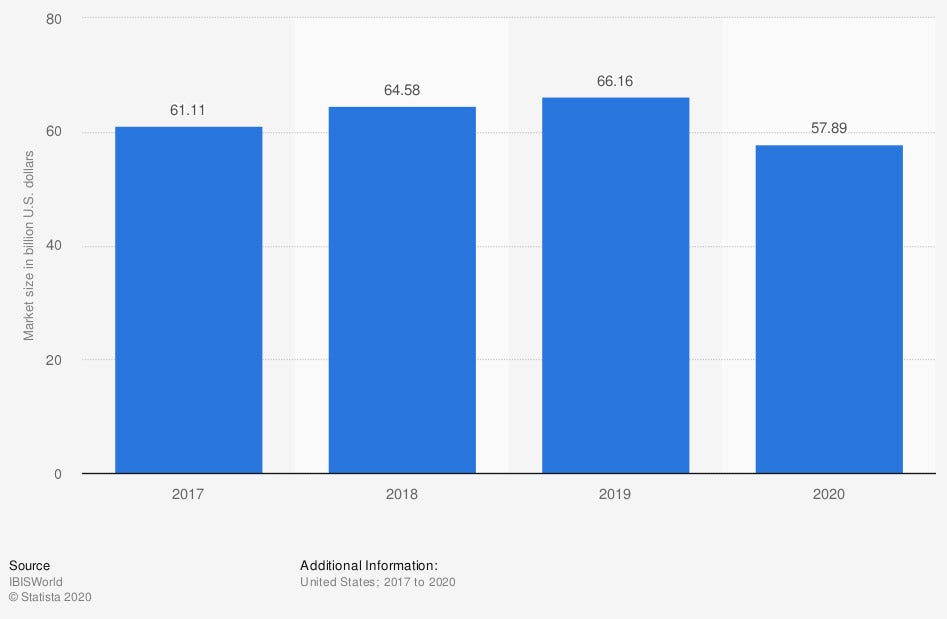

Market size of beauty salons in the US from 2017 to 2020 (in billion US dollars)

The market size of the beauty industry is massive. When you operate a hair salon, you'll want to understand how your coverage works.

What Does Hair Salon Insurance Cover in Kentucky?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. Every policy will be specific to your salon, and limits should be reviewed for accuracy. Check out the most standard coverage options below:

- General liability insurance: Pays for claims for bodily injury or property damage when you or your employees are responsible.

- Business interruption: This will pay for regular business expenses when you are temporarily shut down due to a covered loss.

- Commercial property insurance: Pays for damage to your building, equipment, and inventory from a covered loss.

- Crime insurance: Pays for a claim involving forgery, fraud, or theft to your company.

- Workers' compensation insurance: Pays for an employee's medical expenses resulting from an injury or illness on the job.

- Errors and omissions insurance: Pays for negligence, personal injury, and consulting lawsuits by clients.

How Much Is Hair Salon Insurance in Kentucky?

Your Kentucky hair salon insurance costs will vary and depend on multiple factors. Check out what carriers look at when rating your hair salon coverage:

- Type of operation you run

- Prior claims reported

- Number of years in the industry

- If you have employees

- If you have safety practices

- The value of property owned

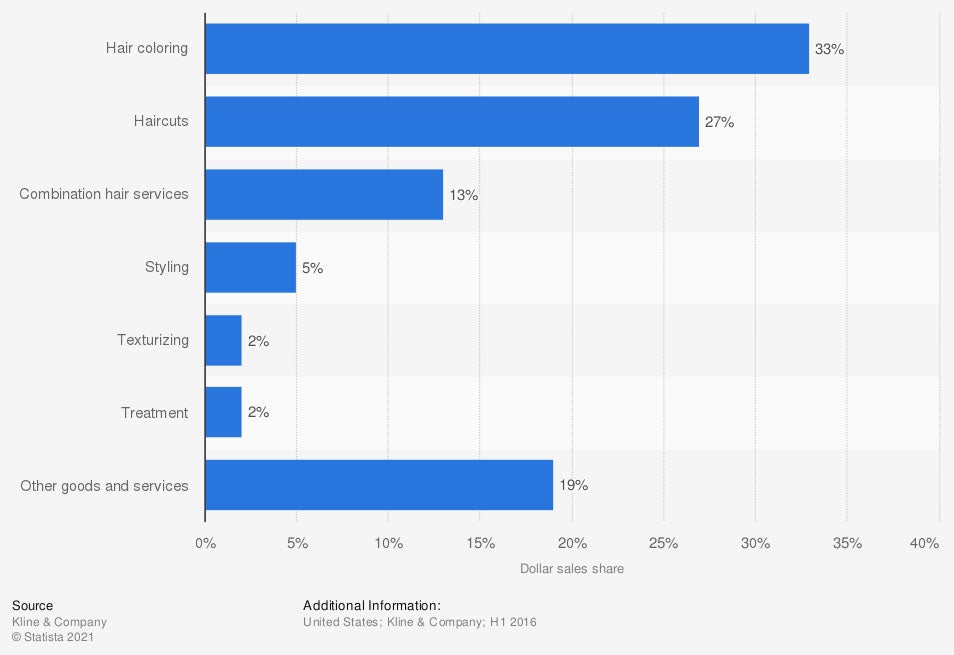

Distribution of dollar sales of hair services at salons in the US in 2016

There are several services your hair salon could offer to clients. Understanding what makes the most profit is a good place to start.

Will My Kentucky Location Impact My Rates?

Where your Kentucky hair salon is located will affect your insurance premiums. Carriers use a variety of location factors to calculate your pricing. Take a look at what could play a role in your insurance costs:

- Local crime rate

- Local natural disasters reported

- Local claims reported by other insureds

- Flood zone assigned

How an Independent Insurance Agent Can Help in Kentucky

If you've been searching for the best hair salon insurance in Kentucky, then you're not alone. A trusted adviser can help you get the policies that fit your needs and budget. They'll review your coverage for free too.

A Kentucky independent insurance agent has a network of carriers so that you have options. With all the policies on the market, it's good to know you have a friend in the business. Connect with a local expert on trustedchoice.com for tailored protection in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/296193/revenue-hair-and-nail-salons-in-the-us/

Graphic #2: https://www.statista.com/statistics/778104/hair-service-sales-share-us/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.