When you run a hotel, there are many things you have to keep in mind at all times, beyond the safety of your guests. Your business property, staff, and guests alike are vulnerable to many threats every day. That’s why having the right hotel insurance is so critical.

Luckily a Kentucky independent insurance agent can help your business get equipped with the enough hotel insurance to get the job done. They’ll even get you covered long before you need to file a claim. But first, here’s a behind-the-scenes look at hotel insurance.

What Is Hotel Insurance?

Hotel insurance is just one specific form of Kentucky business insurance designed to meet the needs of hotels and their owners. Coverage combines the essential protections like property insurance, liability insurance, and business income insurance, and then gets topped off with specifics needed by hotels. Hotel insurance offers several important forms of coverage together in one convenient package.

How to Insure a Hotel in Kentucky

To properly insure your Kentucky hotel, you’ll want to work with a qualified professional. Kentucky independent insurance agents have your back when it comes to getting covered with all the right protections needed by your unique business. Together, you’ll assess your hotel’s unique risks and liabilities and work to assemble a policy that considers them all.

What Does Hotel Insurance Cover in Kentucky?

Hotel insurance isn’t standard, so your policy may differ from the hotel across town. The real goal is to equip your specific hotel with the protections it needs to operate safely and efficiently. According to insurance expert Paul Martin, these are some of the most common coverages needed by most hotels:

- Workers’ compensation: Kentucky requires all businesses with even one part-time employee to offer workers’ comp to protect against employee injury and illness on the job.

- Property insurance: Coverage protects your hotel’s physical building, inventory, and business property from numerous threats, like fire, theft, and more.

- Guest relocation services: Coverage reimburses hotels for costs due to on-site incidents that force guests to be relocated.

- Event cancellation insurance: Coverage reimburses for unexpected event cancellations that result in losses for your hotel.

- Umbrella insurance: Coverage extends the commercial general liability insurance provided by your hotel insurance package, by up to $100 million in additional protection.

- Cyber liability insurance: Coverage protects your business from data breaches and other digital threats that could lead to extreme losses.

Working together with a Kentucky independent insurance agent is a great way to assemble a hotel insurance package that best meets your needs.

Hotel Industry Stats

When shopping for hotel insurance, it’s helpful to know how the industry is performing. Check out some stats for the hotel industry overall below.

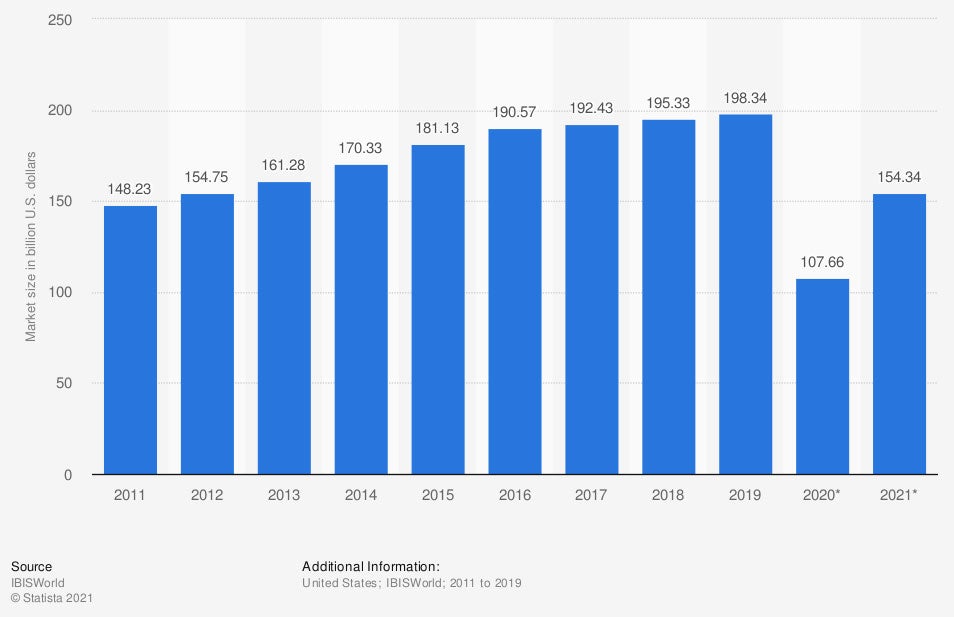

Market size of the hotel and motel sector in the US

In recent years, the hotel industry’s market size has declined considerably. Still, hotels remain a multibillion dollar industry. At the end of the observed period, the hotel industry still generated $154.34 billion. Revenue is projected to continue increasing over the coming years.

With hotels being such a profitable industry, it’s critical to ensure that yours is equipped with all the protection it needs to stay open for years to come.

What Doesn’t Hotel Insurance Cover in Kentucky?

While hotel insurance provides a ton of crucial protection, it can’t cover everything. Martin said the following are common examples of exclusions under hotel insurance:

- Lost inventory

- Robbery

- Nuclear reaction and war damage

- Flood and earthquake damage

- Maintenance costs

- Dishonest acts by staff

Your Kentucky independent insurance agent can listen to any concerns you may have about what’s excluded by your hotel insurance policy, and add more coverage where necessary.

Benefits of Hotel Insurance in Kentucky

Hotel insurance comes with many important benefits. From protecting your guests to your profits, hotel insurance serves many purposes.

A few of the biggest benefits of hotel insurance in Kentucky are:

- Legal protection: Since hotels are typically occupied by a high volume of third parties, they’re also at a heavily increased risk of lawsuits. Fortunately hotel insurance includes liability protection against legal charges, which can be further extended by umbrella insurance.

- Revenue protection: There are many incidents that could lead to your hotel having to close down temporarily, from natural disasters to pandemics and beyond. Fortunately hotel insurance includes business income protection for these unexpected closures.

- Cyber protection: Hotels store credit card numbers along with personal information and other sensitive data that can be vulnerable to theft and more. Fortunately many hotel insurance policies include cyber liability insurance, which protects against data breaches and much more.

Hotel insurance in Kentucky comes with a myriad of benefits beyond those listed above. A Kentucky independent insurance agent can list several others for you.

Here’s How a Kentucky Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect hotel owners against commonly faced liabilities. Kentucky independent insurance agents shop multiple carriers to find providers who specialize in hotel insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/1170216/hotel-and-motel-industry-market-size-us/

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/small-business-insurance-basics

© 2025, Consumer Agent Portal, LLC. All rights reserved.