There are 351,260 small businesses that operate in Kentucky currently. When you're self-employed, it can be exciting being your own boss. To ensure that you're fully protected, Kentucky business insurance can provide coverage as a self-employed entity.

Fortunately, a Kentucky independent insurance agent does the shopping for you at no additional cost. They'll quote your policies through a network of carriers so that you don't have to. Connect with a local expert for tailored protection in minutes.

What Is Self-Employed Insurance?

If you're self-employed in Kentucky, you'll have several coverage options. Take a look at policies that you may want to consider:

- Health insurance: Coverage for an injury or illness.

- Disability insurance: Coverage that will replace income if you become disabled.

- General liability insurance: Pays for a bodily injury or property damage loss.

- Business property insurance: Pays for the replacement or repair of property owned by the business.

- Commercial auto insurance: Pays for a car accident involving a business-owned auto.

- Commercial umbrella insurance: Pays for a liability loss that exceeds your underlying limits.

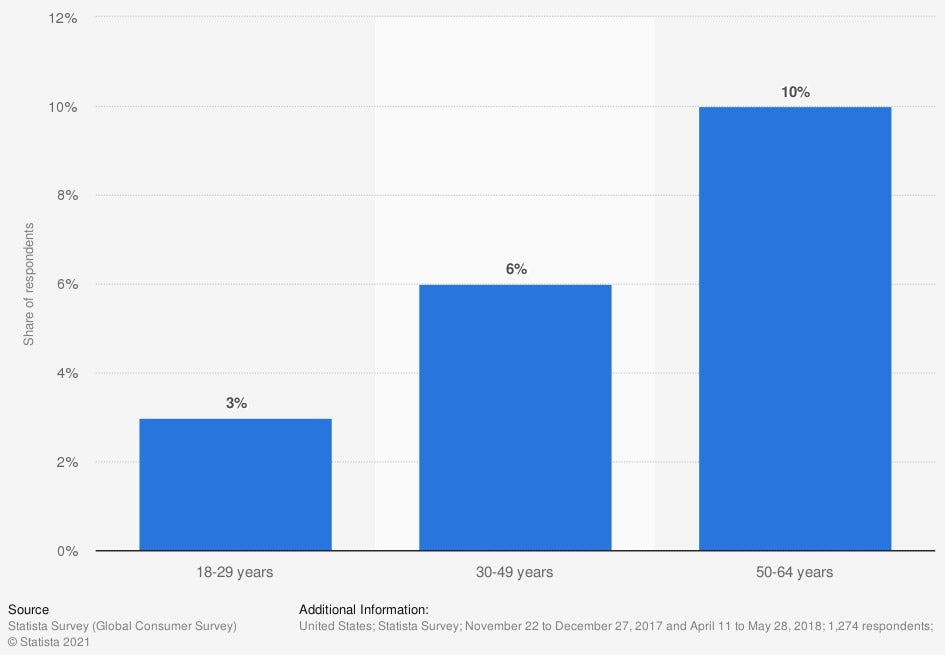

Share of self-employed people in the US in 2018, by age

When you're self-employed, you're not the only one. The right coverage is necessary to avoid financial loss.

Health Insurance Options for Being Self-Employed in Kentucky

If you're self-employed in Kentucky, you'll have to obtain health insurance on your own. Since you won't have a boss to provide health care, these options will be available to choose from:

- Private health insurance: This can be obtained through an independent agent and go through some of the household named carriers. At times, this route can be pricey, depending on who's included in your plan.

- Medical sharing plan: This is not technically insurance but works the same way. You will pay a monthly share amount depending on what program you choose. This share will get pooled with the other members' share amounts. When you have a medical loss, you can file a claim, and the plan will reimburse you from the pool.

- The marketplace: This is insurance through the government marketplace. It can be applied for online at your own risk or through a licensed agent. You will report your annual earnings and then choose from an assigned market at a discount. The less household income you make, the lower your premiums will be.

Best Health Insurance for Being Self-Employed in Kentucky

In Kentucky, you'll have a few different choices when it comes to health care. What's best for your business may not be the same as for another down the street. Check out some factors to consider when deciding on your self-employed health insurance:

Private health insurance option:

- Most expensive

- Works well with most healthcare offices

- May offer the most coverage

- Uses standard health insurance markets

Medical sharing plan option:

- Less expensive

- Has restrictions since it's not insurance

- Has to be reimbursed when a loss occurs

- Most healthcare facilities have not heard of it

The marketplace option:

- Least expensive

- You have to prove your income each year

- Works best for low-income households

- It works well if you have a lot of tax write-offs

- Uses standard health insurance markets

- Not all healthcare facilities accept this plan

Self-Employed Health Insurance Costs in Kentucky

Healthcare premiums have skyrocketed over the years, which can be an issue if you're trying to save money. As a self-employed entity, your insurance costs will vary and depend on numerous risk factors. Take a look at what health insurance companies use to calculate your premiums:

- Location

- Health history

- Your age

- Your weight

- Any current health concerns

- How often you work out

Disability Insurance When You're Self-Employed in Kentucky

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. Some of those losses were due to an injury or illness. Check out what disability insurance has to offer:

- Pays for your lost income when a disability occurs.

- Short-term disability will pay 60% to 70% of your income.

- Short-term disability lasts up to a year in some cases.

- Long-term disability will pay 40% to 60% of your income.

- Long-term disability lasts the length of the disability or until retirement.

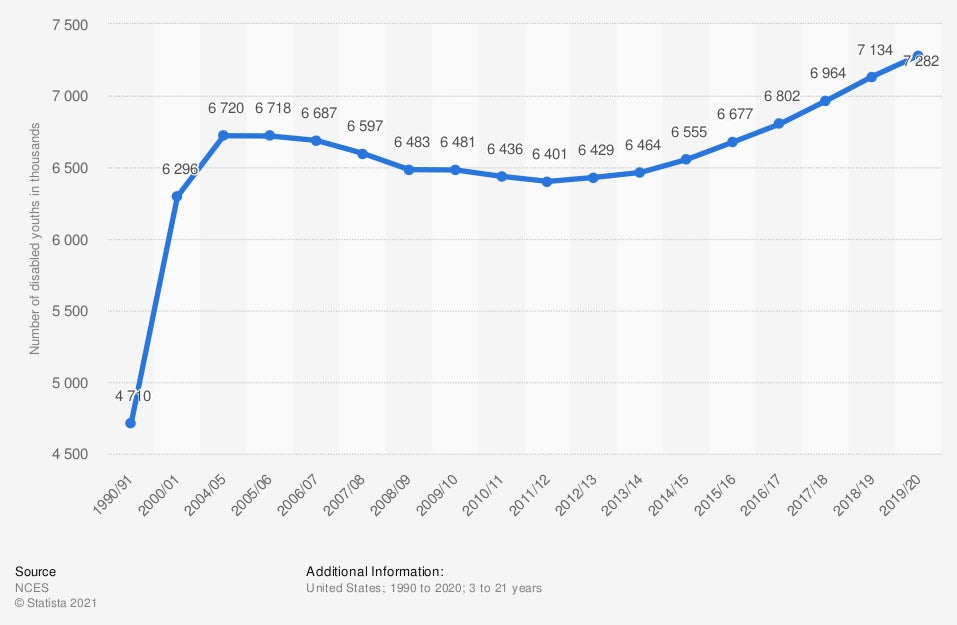

Number of disabled 3 to 21 year olds served under the Individuals with Disabilities Education Act (IDEA) in the US from 1990 to 2020

If you become disabled, it can affect your ability to work. Disability insurance can protect your livelihood as a self-employed person.

Do Self-Employed Workers Need Workers' Compensation Insurance in Kentucky?

In Kentucky, workers' compensation insurance will help pay for an employee's medical expense. If you're self-employed without employees, then you could be asked to provide coverage for a contract job. It's beneficial to know what workers' compensation is in case you ever need it:

- Workers' compensation insurance: Pays for the lost wages and medical expenses of an employee or owner that gets injured or becomes ill while on the job.

How a Kentucky Independent Agent Can Help

When you're self-employed in Kentucky, the world is your oyster. It makes sense to protect what you've worked so hard to build. Fortunately, you're not in it alone, and a trusted adviser can help for free.

A Kentucky independent insurance agent will quote your policies through a network of carriers, giving you options. They'll handle all the shopping and find the best premiums in town. Connect with a local expert on TrustedChoice.com for custom quotes today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/228346/people-who-are-self-employed-usa/

Graphic #2: https://www.statista.com/statistics/236296/number-of-disabled-youth-in-the-us/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.