When you operate a company, it can be a fun and exciting adventure. Every business has industry-specific risks that need to be protected. Fortunately, a Kentucky commercial policy can include the right insurance for your software company.

A Kentucky independent insurance agent will help your business avoid bankruptcy by getting your coverage right from the get-go. They have a network of options and even do the shopping for free. Connect with a local expert to get started today.

What Is Software Company Insurance?

In Kentucky, software company insurance can be purchased through many different policies. Check out some common coverage choices for software companies below:

- General liability: Pays for claims of bodily injury or property damage.

- Business property: Pays for the replacement or repair of any business-owned property.

- Cyber liability: Pays for a lawsuit arising out of a cyberattack when sensitive data has been compromised.

- Business equipment breakdown: Pays for the replacement or repair of business-owned equipment that breaks down.

- Commercial umbrella liability: Pays for a liability loss that exceeds your underlying policy limits.

- Workers' compensation: Pays for an employee's medical expenses and lost wages when they get injured or become ill due to work.

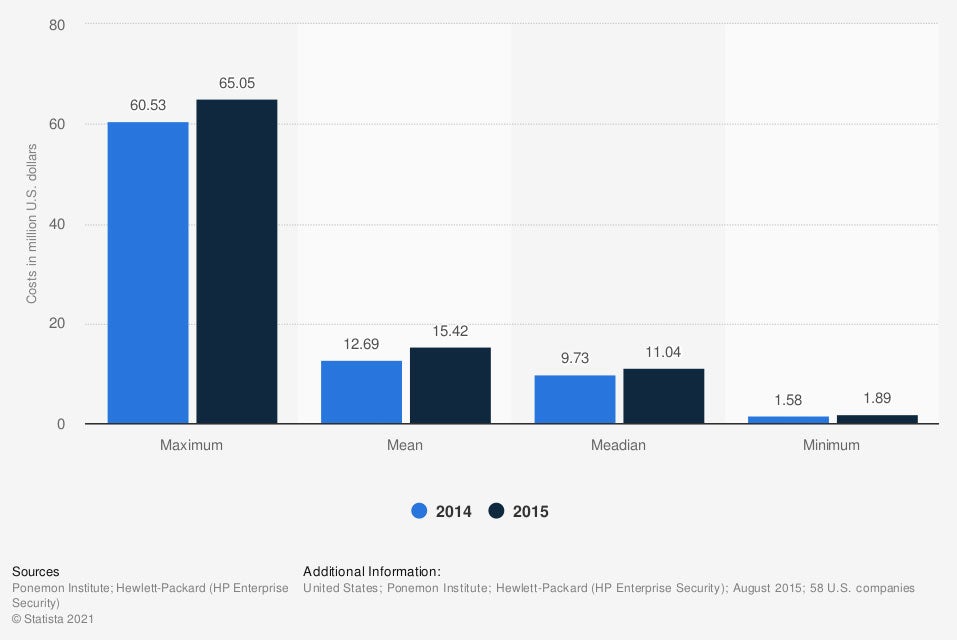

Total annualized cost of cybercrime targeting US companies in 2014 and 2015 (in million US dollars)

When you own a software company, your top exposure will be cybercrime. With the sensitive data you house, predators will be more inclined to steal it.

What Does Software Company Insurance Cover in Kentucky?

Kentucky has 351,260 small businesses in existence. If you run a software company, you'll want to account for all the what-ifs. Let's look at standard software company coverages:

- Coverage for claims of bodily injury or property damage

- Coverage for your business property that is damaged due to a covered loss

- Coverage for a cyberattack

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

Your property policies will typically come with protection against common losses. Automatic coverages include fire, natural disasters, theft, vandalism, and water damage.

How Much Does Software Company Insurance Cost in Kentucky?

In Kentucky, $4,661,744,000 in commercial insurance claims were paid in 2019 alone. Insurance companies calculate your premiums based on several risk factors. Take a look at the things carriers consider when quoting:

- Loss history

- Replacement cost values

- Insurance score

- Anti-malware measures used

- Location

- Local crime rate

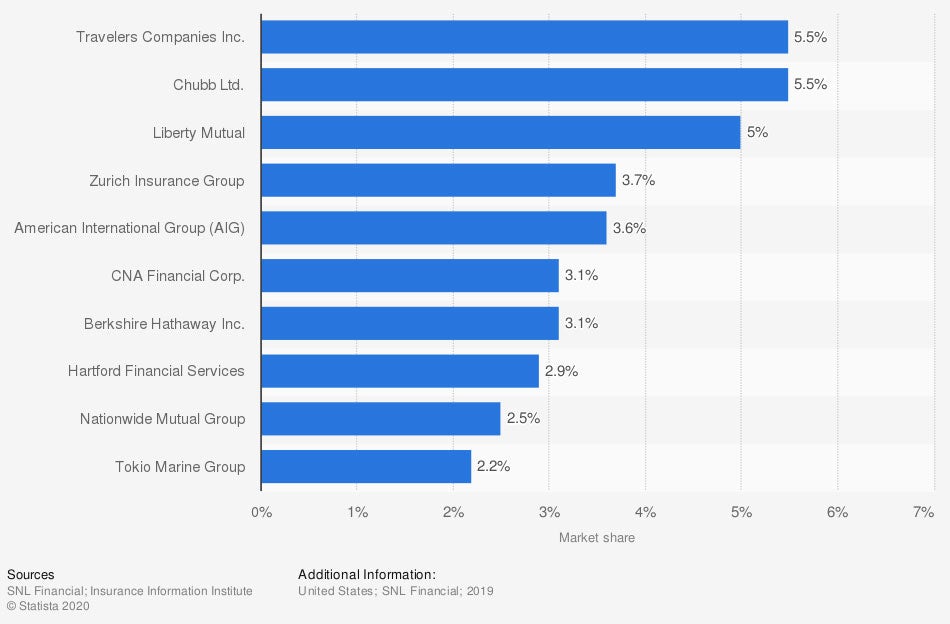

Market share of commercial lines insurance companies in the US in 2019, by direct premiums written

There are a lot of options out there when it comes to commercial insurance. Review your choices with a local adviser for sufficiency.

What Doesn't Software Company Insurance Cover in Kentucky?

All insurance policies will come with a list of exclusions. Your Kentucky software company insurance is no different, and what's not included should be noted. Take a look at standard exclusions on your primary policies:

- Spoilage: This coverage refers to food or items that have spoiled due to an equipment loss. It can usually be added for a fee but won't be automatic in most cases.

- Vehicles: Some insureds think automobiles or company vehicles fall under business equipment, but they don't.

- Structures: If you want coverage for any structures or similar, it will fall under your business property coverage.

- Employee vehicles: If your employees use personal cars to drive to job sites, then they will need to have adequate coverage on their policy.

- Cyber liability: This is a separate policy most of the time and will need to be obtained on its own policy form.

- Flooding: Flood insurance is a stand-alone policy that can be purchased from FEMA-approved carriers.

How an Independent Insurance Agent Can Help in Kentucky

When you're running a business, the last thing you want to think about is insurance. Fortunately, you won't have to do it alone. A licensed professional can review your software company insurance for free.

A Kentucky independent insurance agent will even do the shopping for you through their network of carriers. This ensures that you get the best coverage for an affordable price. Connect with a local expert on TrustedChoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/193444/financial-damage-caused-by-cyber-attacks-in-the-us/

Graphic #2: https://www.statista.com/statistics/186464/leading-us-commercial-lines-insurance-by-market-share/

http://www.city-data.com/city/Kentucky.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.